- SAP Community

- Products and Technology

- Financial Management

- Financial Management Blogs by Members

- ADDITIONAL KPI ON BP AND SCORE CALCULATION IN CRED...

Financial Management Blogs by Members

Dive into a treasure trove of SAP financial management wisdom shared by a vibrant community of bloggers. Submit a blog post of your own to share knowledge.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member65

Discoverer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

12-30-2019

1:38 PM

Summary

The credit management solution in SAP includes two separate modules of SAP, namely SAP FICA and SAP FSCM Credit Management. SAP FSCM credit management is the place where the credit score of the customer is visible.

There might be a need of certain key figures which should also be transferred from SAP FICA to SAP FSCM Credit Management and used thereof to calculate the credit score of the customer. These additional key figures must be added to the Business Partner and few enhancements must be done to get the values from the system and display at the Business Partner level.

The business partner has a credit score which can be derived from internal FICA rating (called Creditworthiness) or any external scores coming from third party systems such as EQUIFAX.

The creditworthiness of a business partner provides information on the business partner’s payment history and influences the selection of activities for dunning and/or returns and also the calculation of charges. Various different business transactions, such as returns, dunning notices, and write-offs update the creditworthiness in the system automatically.

The creditworthiness and payment behavior of the business partners have an immediate effect on the business results of the company. Efficient receivables and credit management reduces the risk of financial losses and helps to optimize business relationships with the business partners.

Business Case

To add certain key figures to the Business Partner for getting a better view of the payment behavior of the business partner.

To calculate the credit score for a business partner with exceptional cases such as the customer is a new customer or customer has special needs (e.g. Deaf or Blind or Mental Health concerns, etc.). If not an exceptional case then the score will be same as the internal FICA score i.e. creditworthiness of the business partner.

Best Practice

Business partner screen need to be enhanced to accommodate the key figures which can be achieved through standard configuration under Financial Supply Chain Management (FSCM). Also, few structures and a table needs to be customized for these Key Performance Indexes. Using proxy channels for communicating between FICA and FSCM.

Using the formula editor provided by SAP to write the formula for calculating the score of the business partner. Implement the BADI (UKM_EV_FORMULA) for adding the additional fields to the formula editor (method ADD_FIELD) and to fill the fields use the FILL_FIELD method. Using proxy channels for communicating between FICA and FSCM.

What SAP has provisioned

SAP suggests to achieve it through standard configuration in both FICA and FSCM modules. For transferring the KPIs from FICA to FSCM, SAP has two proxy channels, one as an outbound from FICA and the other as inbound for FSCM.

SAP facilitates Formula Editor which is a standard SAP functionality and provides the system with the capability to manage exceptional conditions. The Formula Editor is managed by BAU support and requires a change request to change the configuration. It also provides a BADI (UKM_EV_FORMULA) to add fields (method ADD_FIELD) to the formula editor and to fill those fields (FILL_FIELDS). SAP provides two proxy channels, one as an outbound from FICA and the other as inbound for FSCM to replicate the FICA rating.

GAP

For achieving the additional KPIs on Business partner screen, SAP provides configuration in both FICA and FSCM module’s Credit management section. By doing all the configurations required in both the module, and by activating the proxy channels for sending and receiving the data, these KPIs can be visible at the Business Partner screen.

For calculating the score of a business partner for exceptional cases, we need to implement the BADI which will be called while calculating the score for business partner. By activating the proxy channels for sending and receiving the data, FICA rating can be replicated to FSCM.

Solution Options:

As these additional KPIs would be further required for the calculation of the score for the business partner for managing the payment behavior of the business partner, configurations must be done at both FICA and FSCM modules.

Writing the formula in the editor and implementing the BADI for adding additional fields to the formula attributes and filling those fields by fetching the details from the business partner. Proxy channels must be activated.

Configurations

Select the role of business partner as SAP Credit management

In the Tcode: BP, select Change in BP role as SAP Credit Management and save it. In that role, click on ‘Credit Segment Data’ to see the tab ‘Payment Behavior Key Figures’.

Initially, the 3rd tab ‘KPI Payment Behavior’ is not available in the Credit Segment Data. This could be achieved by configuring BUSINESS CONFIGURATION SETS. BC Set is a management tool that allows user to record, save and share customization settings. Once BC sets is configured, the new tab KPI Payment Behavior is visible at BP transaction.

Here, the 3 additional KPIs we are adding are-

- Dunning level

- Move-in date

- Special needs

Structures to be customized for adding 3 KPIs

In table UKMBP_VECTOR_IT, implement the customizing include to add these 3 fields to the business partner screen. The values are stored in this table.

Add the 3 fields to CI_UKM_S_BP_VECTOR_KPI structure.

These 3 fields should also be present at FICA, so add these fields to below structure FKK_CR_KPI_EXTRA_CS.

Implement the customizing include CI_FKK_CR_KPI.

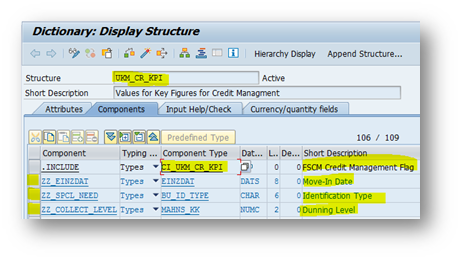

These 3 fields should also be present at FSCM, so add these fields to below structure UKM_CR_KPI.

Implement the customizing include CI_UKM_CR_KPI.

Proxy channels to be activated

Transfer of credit data (Additional KPIs)

- Sender (FICA)

Sender namespace: http://sap.com/xi/FICA/Global

Service provider name: CreditPaymentBehaviourSummaryNotification_Out

- Receiver (FSCM)

Receiver namespace: http://sap.com/xi/FSCM/Global

Receiver provider name: CreditPaymentBehaviourSummaryNotification_In

Replicating FICA rating to FSCM

Sender (FICA)

Sender namespace: http://sap.com/xi/FICA

Service provider name: FICARatingReplicateQuery_Out

Receiver (FSCM)

Receiver namespace: http://sap.com/xi/FSCM

Receiver provider name: FICARatingReplicateQuery_In

Configuration at FICA

Below path to do the configuration at FICA.

Activate credit management: It should be active.

Maintain credit segment:

Assign open items to credit segment

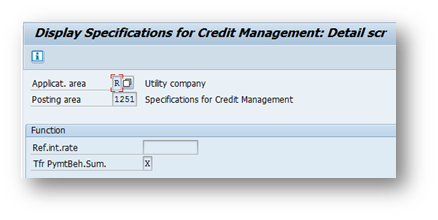

Define specifications for credit management

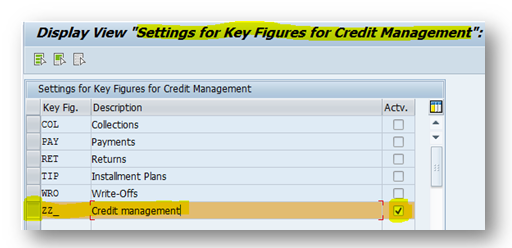

Define key figures for Transfer to Credit management:

Note that the key figure should be of 3 character and the name of all the 3 KPIs should start with that name only.

For example: Here, the key figure we made is ‘ZZ_’ – Credit Management and it is independent.

The field names which we used while enhancing the structure are-

ZZ_EINZDAT

ZZ_SPCL_NEED

ZZ_COLLECT_LEVEL

Hence, the first 3 characters of the field name should be the same as the key figures.

Make specifications for Key figures for credit management:

Note: - Here the key figure we added must be the only one to be active.

Define origin of request for master data change

Configuration for FSCM

Below path to do the configuration at FSCM.

Create credit segments

Define Formulas

Create a new formula.

Click on the Formula Editor

Create Risk Classes

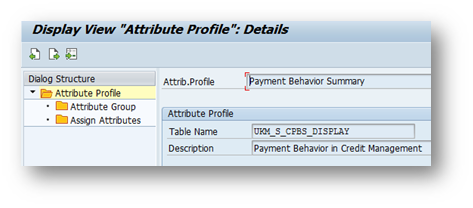

Define attributes display:

This configuration is must for adding the 3 KPIs to Business Partner screen.

Create an attribute group name ‘Additional KPI’

Assign these attributes to attributes group

These 3 KPIs are now visible to BP transaction

FqEvent 4510 needs to be implemented

To display the values in these 3 KPIs, some code has to be written to the FqEvent 4510, where in the changing parameter, our 3 KPIs would already be present in that changing parameter’s structure.

Transfer of credit data (Tcode: FPCM1)

Above FqEvent will be called while transferring the credit data from FICA to FSCM.

After executing the above transaction, changes at business partner screen is visible.

Implementing BADI (UKM_EV_FORMULA)

Method ADD_FIELDS: To add fields to the formula editor. If you put a breakpoint here and open the formula editor in configuration, this method will be triggered.

Method FILL_FIELDS: This method is called at the time of calculating the score i.e. from the BP transaction and while mass update of score transaction (UKM_MASS_UPD2). Here, write the logic to fill the fields which were added to the formula editor which will be used for calculating the score. This method has one returning parameter and it is necessary to pass some value to that returning variable. This returning variable fills the value in that field in the formula editor.

Replicating FICA score to FSCM (Tcode: FPCM2)

After executing FPCM2, the FICA score can be seen at business partner.

Mass Change to Score (Tcode: UKM_MASS_UPD2):

This tcode will set the score at business partner screen. Pass the Rules and Business Partner and the old and new score will be displayed and the new score is reflected at the business partner screen.

Benefits

By implementing the solution the requirement of adding the additional KPIs on Business partner screen can be achieve which would help to see the payment behavior of the business partner and thus reducing the risk of financial losses by taking further action based on the behavior of the business partner.

By looking at the score and the risk class, it can be easily concluded regarding the behavior of the business partner.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

2023 Upgrade

1 -

Accounting & Financial Close

1 -

Accounting and Financial Close

1 -

Assign Missing Authorization Objects

1 -

Bank Reconciliation Accounts

1 -

CLM

1 -

EAM

1 -

Emergency Access Management

1 -

FFID

1 -

FI-AA

1 -

FIN Asset Management

1 -

FIN-CS

1 -

FINANCE

2 -

GRIR

1 -

Group Reporting

1 -

Invoice Printing Lock

2 -

Mapping of Catalog & Group

1 -

Mapping with User Profile

1 -

matching concept and accounting treatment

1 -

Oil & Gas

1 -

Parameter 4026

1 -

Payment Batch Configurations

1 -

Public Cloud

1 -

Revenue Recognition

1 -

review booklet

1 -

S4 HANA

1 -

S4 HANA 2022

1 -

S4 HANA On-Premise

1 -

S4HANA

1 -

SAP BRIM

1 -

SAP CI

1 -

SAP FICO

1 -

SAP RAR

1 -

SAP S4HANA

1 -

SAP S4HANA Cloud

1 -

SAP S4HANA Cloud for Finance

1 -

SAP Treasury Hedge Accounting

1 -

Z Catalog

1 -

Z Group

1

Related Content

- SAP PaPM Cloud UM: Introduction to Important Action Buttons in Financial Management Blogs by SAP

- Using BAPI_BUPA_FS_BPADDITION_CHANGE to update table BP3100 is not working in Financial Management Q&A

- Universal Parallel Accounting in a Nutshell in Financial Management Blogs by SAP

- Climate Change Risk Scenario Analysis in SAP PaPM - 1/3: Climate Risk Management Introduction in Financial Management Blogs by SAP

- SAP Sustainability für Financial Services - Portfolio & Lösungen in Financial Management Blogs by SAP