- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- S/4HANA- New Asset Accounting - Considering Key As...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Employee

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

03-25-2017

6:49 PM

This blog is focused on New Asset accounting for ledger approach in multiple currency environment. New Asset Accounting is the only Asset Accounting solution available in S/4HANA, classic Asset Accounting is not available any more.

I have covered following key topics within S/4HANA New Asset Accounting keeping in view various questions coming in from different customers/partners on this key innovation step taken within Finance as part of S/4HANA simplification and we need to be very clear on this new requirement before starting the new or conversion S/4HANA project.

1. Pre-requisite Business Functions

2. Data Structure Changes in Asset Accounting

3. New FI-AA-Integration with the Universal Journal Entry

4. Asset Accounting Parallel Valuation

5. Key Configuration Consideration in Ledger Approach

6. Why will use a technical clearing GL account

7. New Asset Accounting Posting Logic

8. FI-AA Legacy Data Transfer

9. Adjusting chart of Depreciation Prior to Conversion

10. Installing SFIN in Conversion/Migration Scenario

11. Subsequently create a new depreciation area in New Asset Accounting

1. Pre-requisite Business Functions

Activate the following Business Functions

- ENTERPRISE_BUSINESS_FUNCTIONS – FIN_AA_PARALLEL_VAL (always active with S/4HANA)

- Please refer last section of this blog for more detail on business functions.

2. Data Structure Changes in Asset Accounting

Actual data of ANEK, ANEP, ANEA, ANLP, ANLC is now stored in table ACDOCA. ANEK data is stored in BKPF.

Compatibility views FAAV_<TABLENAME> (for example, FAAV_ANEK) are provided in order to reproduce the old structures.

Statistical data (for example, for tax purposes) previously stored in ANEP, ANEA, ANLP, ANLC is now stored in table FAAT_DOC_IT

Plan data previously stored in ANLP and ANLC is now stored in FAAT_PLAN_VALUES

Classic Asset Accounting is mostly transformed automatically into the New Asset Accounting by executing mandatory migration steps related to Asset Accounting.

As of release SAP S/4HANA 1809, the BSEG table will no longer be updated with the depreciation run (transaction AFAB, AFABN- Refer SAP Note 2383115. It is also no longer possible to subsequently activate this update.

Posting to different periods possible (restriction: beginning/end of FY needs to be equal) refer OSS note 1951069/ 2220152

Following table shows some redundant/new Asset accounting programme.

3. New FI-AA-Integration with the Universal Journal Entry

Asset Accounting is based on the universal journal entry. This means there is no longer any redundant data store, General Ledger Accounting and Asset Accounting are reconciled Key changes are listed below: -

There is no separate balance carry forward needed in asset accounting, the general balance carry forward transaction of FI (FAGLGVTR) transfers asset accounting balances by default.

The program Fixed Assets-Fiscal Year Change (RAJAWE00) transaction AJRW is no longer has to be performed at fiscal year change

Planned values are available in real time. Changes to master data and transaction data are constantly included

The most current planned depreciation values will be calculated automatically for the new year after performing the balance carry forward. The depreciation run posts the pre-calculated planned values.

The Selection screen is simplified as the “reasons for posting run” (planned depreciation run, repeat, restart, unplanned posting run) are no longer relevant.

Errors with individual assets do not necessarily need to be corrected before period-end closing; period-end closing can still be performed. You have to make sure that all assets are corrected by the end of the year only so that depreciation can be posted completely.

All APC changes in Asset Accounting are posted to the general ledger in real time. Periodical APC postings are therefore no longer supported.

Transaction types with restriction to depreciation areas are removed in new Asset Accounting and you can set the obsolete indicator in the definition of the transaction that were restricted to depreciation areas in the classic asset accounting.

4. Asset Accounting Parallel Valuation

Very Important part of new Asset accounting is parallel valuation in multicurrency environment.

The leading valuation can be recorded in any depreciation area. It is no longer necessary to use depreciation area 01 for this. The system now posts both the actual values of the leading valuation and the values of parallel valuation in real time. This means the posting of delta values has been replaced; as a result, the delta depreciation areas are no longer required.

New Asset Accounting makes it possible to post in real time in all valuations (that is, for all accounting principles). You can track the postings of all valuations, without having to take into account the postings of the leading valuation, as was partly the case in classic Asset Accounting.

5. Key Configuration Consideration in Ledger Approach

We need to answer some basic question before configuring new asset accounting in S4 Hana environment as this would determine the required minimum depreciation areas to align the FI with Asset Accounting. i.e.

Required Valuation Approach

How Many Ledgers (Leading + Non Leading) exists or to be configured.

What all currencies are used in each of the ledgers.

For Example:-

In this Example we have one com code which has 2 ledgers 0L & N1 & these 2 ledgers having 3 currencies i.e 10,30 & 40 as shown below.

Above mapping is to ensure and establish link between depreciation area/accounting principal and Currency

Explaining with ledger approach example. From release 1503 i.e initial version of SAP Finance add on version in S4 Hana a new table ACDOCA is introduced which stores the asset values also per ledger /per currency on real time basis & no need to have any reconciliation between Finance and Asset accounting and to do so it is must to follow the guidelines while setting up depreciation areas & respective currencies, which I have tried to explain with an example as given below: -

Ledger & currency setting has to be done in New GL in the following SPRO node.

Financial Accounting (New)--> Financial Accounting Global Settings (New)--> Ledgers--> Ledger --> Define Settings for Ledgers and Currency Types

Fixed Asset Accounting currently only supports the FI relevant (BSEG-) Currencies.

For additional currency types, which are not BSEG relevant, you do not need to create dep area; these currencies are converted during posting. This means, the sum of all depreciations does not balance with the activation value for the additional currencies.

It is on roadmap for later releases, that Fixed Asset Accounting calculates the depreciation with the historic (activation) values in all currencies, but currently Fixed Asset Accounting does this only in the BSEG Currencies.

Define Depreciation Areas

Depreciation Areas defined as per new FI-GL & FI-AA requirement so here at least 6 depreciation areas are must so that ledger wise each currency can be represented in separate depreciation area & these depreciation area is assigned to Accounting principal.

Specify Depreciation Area Type

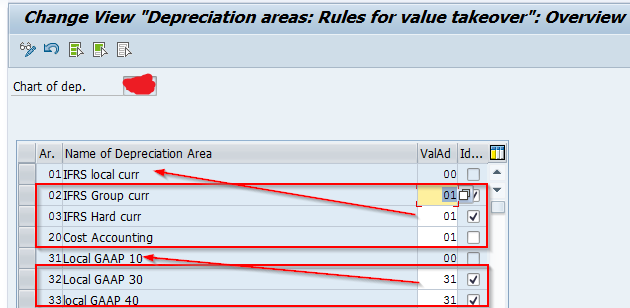

Specify Transfer of APC Values

In this activity, you define transfer rules for the posting values of depreciation areas. These transfer rules let you ensure that certain depreciation areas have identical asset values

Specify Transfer of Depreciation Terms

In this activity, you specify how the depreciation terms for a depreciation area are adopted from another depreciation area. You can specify if the adoption of values is optional or mandatory. If you specify an optional transfer, then you can change the proposed depreciation terms in the dependent areas in the asset master record. In the case of a mandatory transfer, you cannot maintain any depreciation terms in the asset master record. In this way, you can ensure that depreciation is uniform in certain depreciation areas.

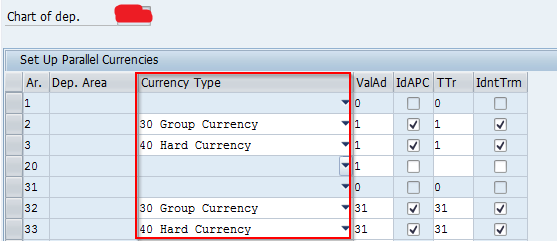

Define Depreciation Areas for Foreign Currencies

For every additional currency type defined on the company code a corresponding depreciation area needs to be set up.

As explained in previous step here we need to define the currency for each dep area so for example if a company code has 2 ledgers i.e 0L and N1 with 3 currencies then at least 6 depreciation areas should be setup & currencies should be assigned for each depreciation area ( Here leading valuation depreciation area will derive currency from com code currency)

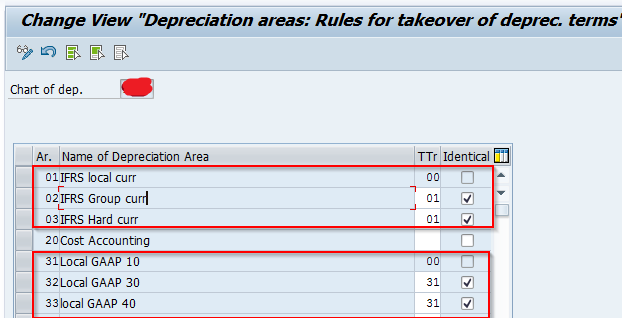

Specify the Use of Parallel Currencies

Here we need to specify the Currency type for each for the Depreciation area which will align FI Currency type with Asset Depreciation areas & accordingly will be updated in ACDOCA.

With this setting its ensured that all currency types are aligned with respective depreciation area and asset values are getting updated parallel to Financial accounting per currency.

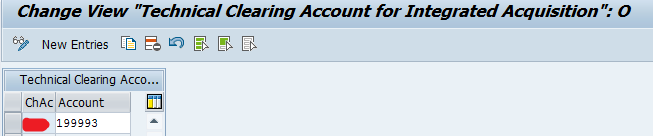

6. Why will use a technical clearing GL account

Architecture has been changed in the way that we now post in asset accounting for each valuation a separate document. So we perform on the asset part accounting principle specific postings. Technically we perform ledger-groups specific postings.

On the operational part (accounts receivable, accounts payable) the value is always the same for each accounting principle. So for the operational part we have to perform postings which are valid for all accounting principles. Technically we perform postings without specifying the ledger-group.

To split the business process in an operational and a valuating document there was a need to establish the “technical clearing account” for integrated asset acquisition.

- For the operational part (vendor invoice/GRIR), the system posts a document valid for all accounting principles against the technical clearing account for integrated asset acquisitions. From a technical perspective, the system generates a ledger-group-independent document.

- For each valuating part (asset posting with capitalization of the asset), the system generates a separate document that is valid only for the given accounting principle. This document is also posted against the technical clearing account for integrated asset acquisitions. From a technical perspective, the system generates ledger-group-specific documents.

Define account “Technical clearing account” for integrated asset acquisition.

Specify Alternative Document Type for Accounting Principle-Specific Documents

Here Operational document type will have original document used during entry & while generating accounting principal wise separate document it would be document type AA.

7. New Asset Accounting Posting Logic

The Operational Entry Document posts to a technical clearing account. The Operational Entry Document does not update the asset values; the asset data is only used to perform checks.

Accounting principle specific documents (1 to n). The accounting principle specific documents post to: - the technical clearing account in each view (balancing to zero) and the asset reconciliation account (and update the asset line items).

Asset Acquisitions Operational Document

Asset Acquisitions Accounting Principal (IFRS) specific Document

Asset Acquisitions Accounting Principal (LOCA) specific Document

Universal Table updated with respective ledger (0L & N1) and currencies.

Correction Asset Acquisition value in specific GAAP

Use Transaction code AB01L

8. FI-AA Legacy Data Transfer

You create asset master records for the legacy data transfer using transaction AS91.

You post the transfer values using transaction ABLDT; in doing so, a universal journal entry is posted for the fixed asset.

If wrong transfer values were posted, you must reverse the journal entry and then recreate it.

You can use transaction AS92 to change master data; transaction AS93 to display master data; and transaction AS94 to create sub numbers for the Asset master record.

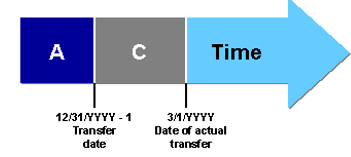

Time of Legacy Asset Transfer

The transfer date is the cut-off date for the transfer of legacy data. The transfer will only include data up to this point in time. There are two possible scenarios.

The transfer date can be the end of the last closed fiscal year.

The transfer date can be in the fiscal year. This is called "transfer during the fiscal year.

Scenario 1: Transfer Date is the End of the Last Closed Fiscal Year:

In this case, you do not need to include any posted depreciation or transactions in the transfer of legacy data. You only need to transfer master data and the cumulative values as of the end of the last closed fiscal year.

Scenario 2: Transfer During the Fiscal Year

Along with the general master data, and the cumulative values from the start of the fiscal year (time period A), you must also transfer the following values.

Depreciation during the transfer year and Transactions during the transfer year

Include the depreciation posted in the legacy system since the end of the last closed fiscal year up to the date of transfer (time period B).

Any asset transactions in your legacy system that have a value date after the transfer date, but before the date of the physical transfer of data (time period C), need to be posted separately in the Asset Accounting component in any case.

Example of scenario 2 Legacy Data Transfer During the Fiscal year:-

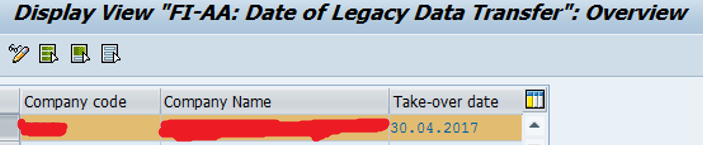

Case: Legacy asset is acquired in previous year 01.01.2015 and taken over into simple finance system in mid-year of current year (30.04.2017)

Specify Transfer Date/Last Closed Fiscal Year (V_T093C_08)

Specify Last Period Posted in Prv. System (Transf. During FY) (OAYC)

Step 1:- AS91 to create Legacy asset master data

Step 2:- ABLDT to update Legacy Original Acquisition Value/ Accumulated Depreciation and current year Depreciation Posted.

Step 3: Verify Legacy Asset Planned Value

Step 4: Verify Legacy posted Value

Note:-

SAP has provided standard tool to create legacy asset as well as upload balances together using transaction code LTMC .

Alternatively you may use BADI also as per SAP note 2270388 , this note as very detailed and explains most of the changes with new Asset accounting in S/4HANA.

9. Adjusting Chart of Depreciation prior to Conversion

For the leading valuation of the ledger approach and accounts approach and for parallel valuations of the ledger approach its must that the parallel currencies in the leading ledger in General Ledger Accounting and in the depreciation areas in Asset Accounting must be the same as explained one example above with ledger approach scenario.

Using the migration program available under Migration Tools, you can automatically adjust the parameters in your charts of depreciation. If error messages appear stating that automatic adjustment is not possible, you have to adjust the charts of depreciation manually.

If until now you have been using parallel currencies in General Ledger Accounting, but you have not implemented the corresponding parallel currency areas in Asset Accounting for all depreciation areas, you must implement these areas in a separate project before you install SAP Simple Finance. In such a project, you must first perform the preparatory steps for creating depreciation areas in Customizing; you must then determine the new values for each fixed asset for a newly created depreciation area.

For company codes that are assigned to the same chart of depreciation, these company codes are not allowed to differ in number and type from the parallel currencies used in General Ledger Accounting.

Even if you migrate to SAP Accounting powered by SAP HANA from a system (e.g. EHP7) having FI-AA (new) already active, you still must migrate every active chart of depreciation.

10. Installing SFIN in Conversion/Migration Scenario

From the viewpoint of Asset Accounting, it is not necessary that you install SAP Simple Finance at the end of the year or period. However, it is required that you perform a complete period-end closing directly before you install SAP Simple Finance and some of the important point you must consider w.r.t New Asset Accounting. (for detail you may refer conversion guide)

To check if the prerequisites outlined are met, you have to check using the program for preliminary checks RASFIN_MIGR_PRECHECK. You import the current version of this program using SAP Note 1939592, before you install SAP Simple Finance in your system. Perform this check in all of your systems - in the Customizing system as well as in the downstream systems (test system and production system).

If until now you updated transactions in parallel valuations with different fiscal year variants and want to continue using this update, then you must implement a new representative ledger using the SAP General Ledger Migration Service before you install SAP Simple Finance. For more information about alternative fiscal year variants with parallel valuation, see SAP Note 2220152 Information published on SAP site.

You must have performed periodic APC posting (RAPERB2000) completely; the timestamp must be current.

Execute the periodic depreciation posting run (RAPOST2000).

Run the program for recalculating depreciation (transaction AFAR).

Reconcile your general ledger with the Asset Accounting subsidiary ledger, both for your leading valuation and for parallel valuations.

The migration must take place at a time when only one fiscal year is open in Asset Accounting.

You can check which fiscal year is closed in your company code in Customizing for Asset Accounting (New) under Preparations for Going Live à Tools à Reset Year-End Closing.

Ensure that no further postings are made in your system after running period end transactions before installing S4 Hana Simple Finance hence lock the users.

Perform a backup before installing SFIN

As soon as you have installed SAP Simple Finance, you can no longer post in Asset Accounting. To ensure that migration is successful, it is essential that you make sure that the prerequisites are met and a complete period-end closing was performed before you install SAP Simple Finance. Posting for new Asset Accounting is only possible again after you have completed the migration fully and successfully.

After completing the migration, make sure that no fiscal year that is before the migration is reopened in Asset Accounting.

11. Subsequently create a new depreciation area in New Asset Accounting.

Program RAFABNEW

This programme RAFABNEW Subsequent implementation of a new depreciation area available is not available with SAP S/4HANA because of Introduction of the journal entry with changed data structures

Hence if you need to setup a depreciation area as part of requirement of conversion from ECC to S/4HANA then setup new depreciation area in ECC only using programme RAFABNEW

Program RAFAB_COPY_AREA

This programme is available with SAP S/4HANA 1809 version onwards and this can be used to setup a new derpreciation area in SAP S/4HANA

For detail you may refer SAP note 2403248

Latest Updates on year end closing for S/4HANA 1909 and 2020

As of release SAP S/4HANA 1909, year-end closing is executed and reset using transaction FAA_CMP. The following applies for a ledger:

- You can close a fiscal year for accounting for a ledger or a depreciation area.

- You can also reopen the fiscal year last closed for one or more depreciation areas.

Despite these adjustments, program RAJABS00 (transaction AJAB) is still available in the SAP Easy Access menu (only until release SAP S/4HANA 1909).

In addition, as of SAP S/4HANA 2020, the program Year-End Closing Asset Accounting (Cross-Company Code and Ledger) (program FAA_CLOSE_FISCAL_YEARS, transaction FAA_CLOSE_FISC_YEARS) is available. You use this program to close a fiscal year from an accounting perspective for one or more company codes or ledgers.

For detail you may refer SAP note 2270388

Additional updates regarding business functions:-

EA-FIN

Before the installation of the SAP S/4HANA, you must activate Financials Extension (EA-FIN), this will enable the new depreciation calculation engine, also EA-FIN should be activated in ECC system before installing SAP S/4HANA as a separate project activity.

Please refer this for additional detail - https://help.sap.com/viewer/67e323b7117e4c91869c258933f47182/2020.001/en-US/3564d652bc8fbe66e1000000...

FIN_AA_PARALLEL_VAL

This business function is available from ECC 6.0 EHP7 SPS2 onwards and supports you with parallel accounting. Asset Accounting performs real ledger-group-specific postings. In contrast to the use of delta depreciation areas, postings are now fully clear and trackable. In addition, this opens up improved options in reporting. You can now flexibly assign the depreciation areas of new Asset Accounting to the ledger groups of the general ledger. The fixed linkage of depreciation area 01 to the leading ledger in the general ledger no longer applies. The system posts parallel values with the actual values in Realtime; separate documents are posted for each valuation. This means the posting of delta values has been replaced; as a result, the delta depreciation areas are no longer required.

When you migrate to SAP S/4HANA you will be automatically switched to new asset accounting. The new asset accounting is activated as soon as the FIN_AA_PARALLEL_VAL is activated

New Asset Accounting is the only solution going forward. Note that this is no longer dependent on the FIN_AA_PARALLEL_VAL business function. If you go to SFW5 and see that it’s inactive, you may think that New Asset Accounting is not active, but that’s not the case. Whether the function is active or not, only New Asset Accounting is in the system as this is by default option with SAP S/4HANA without them being linked to the business function.

Please refer this for additional detail - https://help.sap.com/viewer/DRAFT/09d5264e467d4491a82a32335a52e45f/1909.latest/en-US/fe8c1b4057f3409...

Brought to you by the S/4HANA RIG

Thanks

Ajeet Agarwal

SAP S/4HANA Regional Implementation Group- APJ

- SAP Managed Tags:

- SAP S/4HANA,

- SAP S/4HANA Finance,

- FIN (Finance),

- FIN Asset Accounting

Labels:

64 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

29 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

28 -

Expert Insights

114 -

Expert Insights

185 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,679 -

Product Updates

267 -

Roadmap and Strategy

1 -

Technology Updates

1,499 -

Technology Updates

97

Related Content

- Event Based Revenue Recognition - Sell from Stock (1K2) with Recognition Key - SFSCCM in Enterprise Resource Planning Blogs by SAP

- Subscription Billing with Convergent Invoicing and Contract-Based Revenue Recognition in Enterprise Resource Planning Blogs by SAP

- how to create order accounts and how to manage them on sap gui in Enterprise Resource Planning Q&A

- Security Deposits Suppliers - Best Practice in Enterprise Resource Planning Q&A

- How to select other user name in outgoing payment draft without assign superuser to user account in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 6 | |

| 4 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 | |

| 2 | |

| 2 |