- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Mexico CFDI 3.3 invoice in SAP S/4HANA Cloud

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Product and Topic Expert

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

2020 Apr 08

4:39 PM

9,921

- SAP Managed Tags:

- SAP S/4HANA Cloud Public Edition Sales,

- SD Sales,

- SAP S/4HANA Cloud Public Edition

The e-invoice in Mexico is the final document in an regular OTC process. CFDI 3.3 document is the only valid invoice document for the fiscal Mexican authorities.

In this blog post we will see how to prepare the system to trigger the electronic invoices document for the customers using the standard functionality for Mexico localization in SAP S/4HANA Cloud.

We will start with the first steps of configuration of the localization for e-inoice for Mexico.

Configure Value Mapping.

With the role of Configuation Expert (BR_CONF_EXPERT_BUS_NET_INT) open the app of Configure Value Mapping.

This process steps show you how to create the required value mapping for generate the electronic invoices.

Blart, payment document types

CFDI_PAYMETHOD Assign SAT(Mexican fiscal authorities) Payment Method codes. Those are the relation between SAP payment terms and SAT payment method codes (all the SAT codes catalog you can find it in the web page of the SAT).

CFDI_PAYMNT_MEANS Means of payment. Relation between payment method from SAP S/4HANA Cloud and payment means of the SAT authorities.

CFDI_TAXES_ASSIGN Assign SAT Tax types and factor types. You need to assign all the tax types you will be use in SAP S/4HANA Cloud and the relation with the SAT tax type.

CFDI_USAGE Use of CFDI for correponding customer. Assign the corresponding CFDI usage at your customers, according at the type of transaction (This information is available in SAT catalog of CFDI in SAT government portal).

Note: In case you need to create your own logic for filling CFDI_USAGE per customer, you can implement the localization BADI for Mexico Usage of CFDI, this BADI is called during the maping of the XML, which is triggered when you submit an eDocument from the Mexico eInvoice processes of the eDocument Cockpit.

DOC_TYPE Document type. Identify for the SAT authorities what kind of transaction (incoming or egress) represent the document types used in SAP S/4HANA Cloud.

FORMA_PAGO Method of payment of the transaction.

PRODUCT_CODE Assign Product/Service codes to material numbers. It is the relation between the SAP products or services codes in your SAP S/4HANA Cloud system between the SAT codes, provided in the SAT catalog that you can download from SAT portal.

SERVICE_PROVIDER Assign service provider for a company code. Assign the name of your PAC (authorized supplier by the SAT to certified the e-invoice) provider for your company code.

TIPO_RELACION Relation type based on related document type. Relation between CFDI (SAT) documents and SAP S/4HANA Cloud documents.

UNIT_OF_MEASURE Value mapping for UOM with SAT description. Assign the relation between the unit of measures in SAP S/4HANA Cloud and SAT unit of measures (available in the SAT catalog mentioned above).

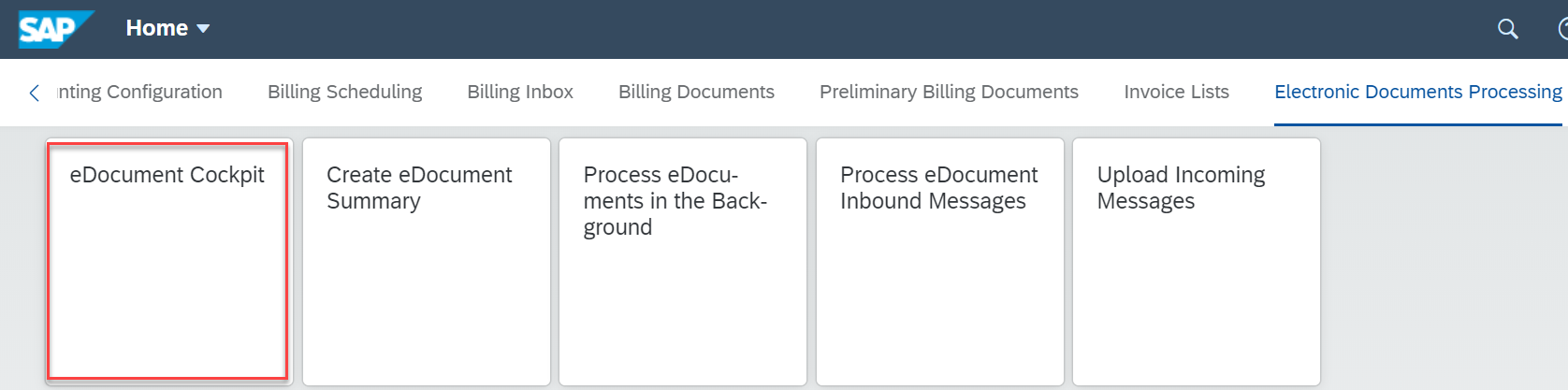

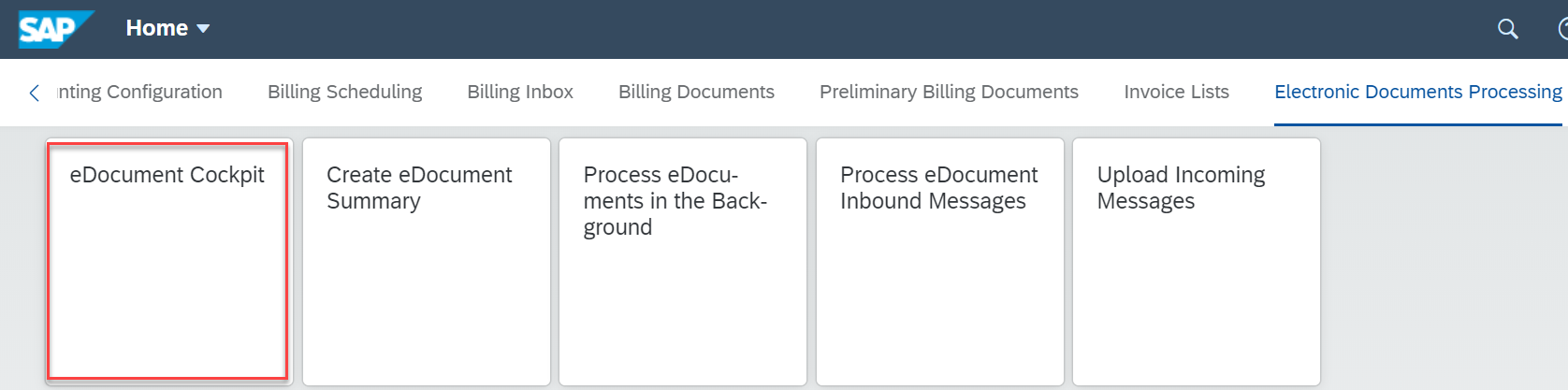

After you end all those previous steps, you can trigger you e-invoice documents, below show you how after invoice document is generated in billing in the create billing documents app, the invoice document is trigger to e-document cockpit.

In e-document cockpit we can see our invoice document, in preview status to be submitted to the PAC.

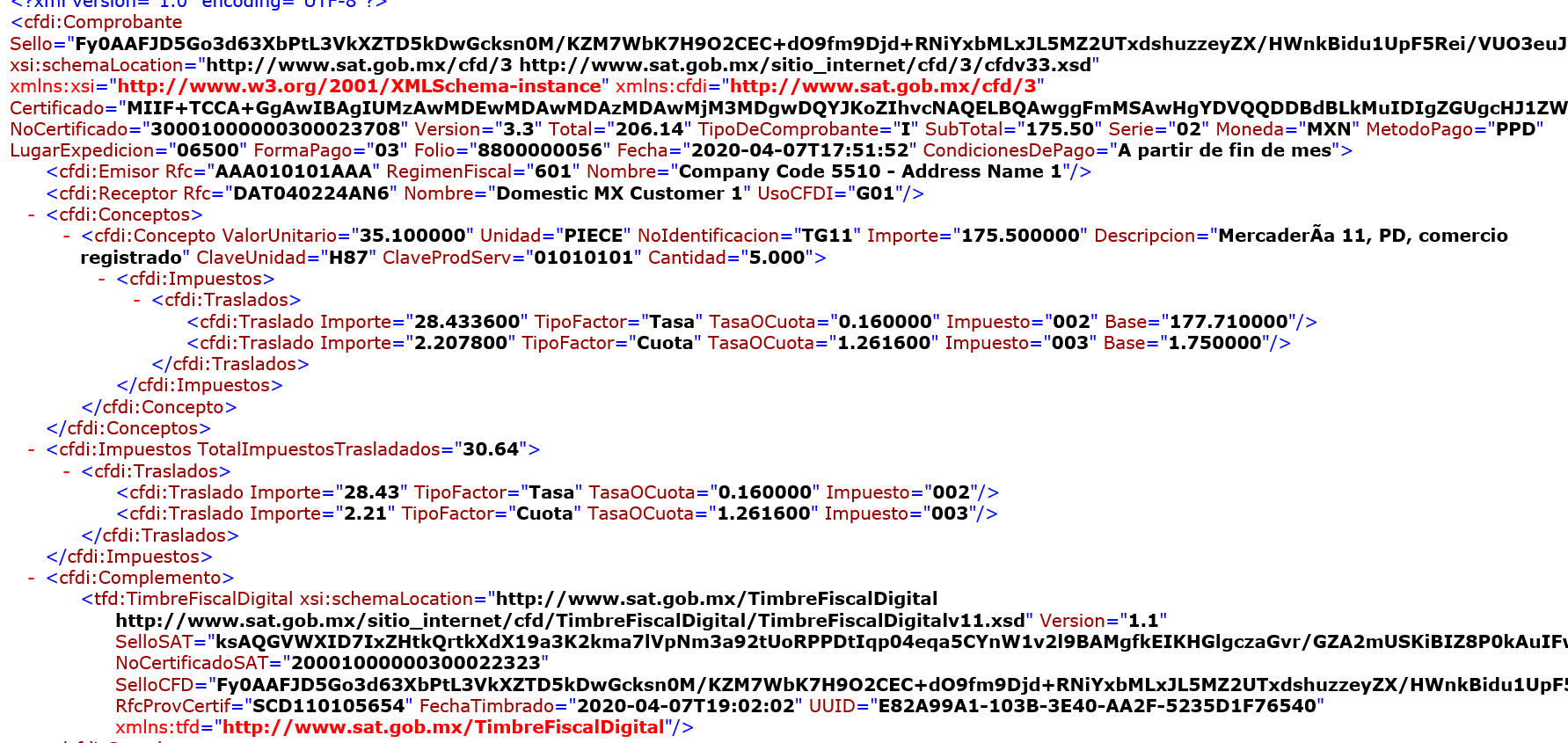

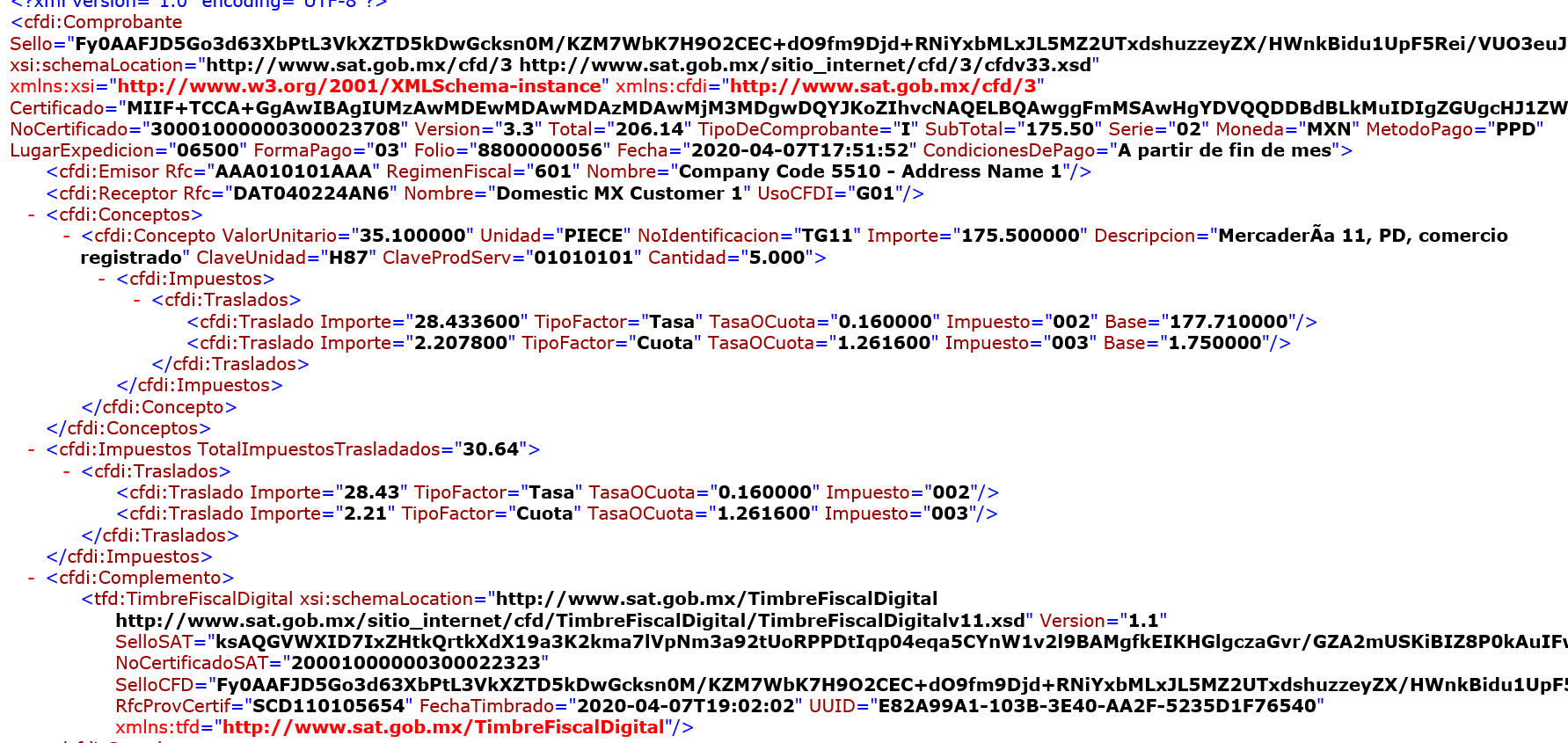

Once the invoice it´s submitted if everything was configured correct and the connection with the PAC it´s in place, you will see the status change in green color and the message "accepted by the authorities" that means your document have all the fiscal requirements and the XML document obtain the fiscal stamp and it´s a valid document as the image below..

The image below is the xml sample of the invoice triggered above.

Additional you can see the representative printing version of the XML obtained.

We saw from functional perspective all the previous requirement to configure the value mappings to obtain e-invoice document in Mexico will all the requirements needed by fiscal authorities, using the standard functionality of SAP S/4HANA Cloud. Please follow all the steps and follow our best practices to obtain the reach the goal in SAP S/4HANA Cloud.

Please feel free to contact me by direct message or an e-mail, thanks.

In this blog post we will see how to prepare the system to trigger the electronic invoices document for the customers using the standard functionality for Mexico localization in SAP S/4HANA Cloud.

We will start with the first steps of configuration of the localization for e-inoice for Mexico.

Configure Value Mapping.

With the role of Configuation Expert (BR_CONF_EXPERT_BUS_NET_INT) open the app of Configure Value Mapping.

This process steps show you how to create the required value mapping for generate the electronic invoices.

Blart, payment document types

CFDI_PAYMETHOD Assign SAT(Mexican fiscal authorities) Payment Method codes. Those are the relation between SAP payment terms and SAT payment method codes (all the SAT codes catalog you can find it in the web page of the SAT).

CFDI_PAYMNT_MEANS Means of payment. Relation between payment method from SAP S/4HANA Cloud and payment means of the SAT authorities.

CFDI_TAXES_ASSIGN Assign SAT Tax types and factor types. You need to assign all the tax types you will be use in SAP S/4HANA Cloud and the relation with the SAT tax type.

CFDI_USAGE Use of CFDI for correponding customer. Assign the corresponding CFDI usage at your customers, according at the type of transaction (This information is available in SAT catalog of CFDI in SAT government portal).

Note: In case you need to create your own logic for filling CFDI_USAGE per customer, you can implement the localization BADI for Mexico Usage of CFDI, this BADI is called during the maping of the XML, which is triggered when you submit an eDocument from the Mexico eInvoice processes of the eDocument Cockpit.

DOC_TYPE Document type. Identify for the SAT authorities what kind of transaction (incoming or egress) represent the document types used in SAP S/4HANA Cloud.

FORMA_PAGO Method of payment of the transaction.

PRODUCT_CODE Assign Product/Service codes to material numbers. It is the relation between the SAP products or services codes in your SAP S/4HANA Cloud system between the SAT codes, provided in the SAT catalog that you can download from SAT portal.

SERVICE_PROVIDER Assign service provider for a company code. Assign the name of your PAC (authorized supplier by the SAT to certified the e-invoice) provider for your company code.

TIPO_RELACION Relation type based on related document type. Relation between CFDI (SAT) documents and SAP S/4HANA Cloud documents.

UNIT_OF_MEASURE Value mapping for UOM with SAT description. Assign the relation between the unit of measures in SAP S/4HANA Cloud and SAT unit of measures (available in the SAT catalog mentioned above).

After you end all those previous steps, you can trigger you e-invoice documents, below show you how after invoice document is generated in billing in the create billing documents app, the invoice document is trigger to e-document cockpit.

In e-document cockpit we can see our invoice document, in preview status to be submitted to the PAC.

Once the invoice it´s submitted if everything was configured correct and the connection with the PAC it´s in place, you will see the status change in green color and the message "accepted by the authorities" that means your document have all the fiscal requirements and the XML document obtain the fiscal stamp and it´s a valid document as the image below..

The image below is the xml sample of the invoice triggered above.

Additional you can see the representative printing version of the XML obtained.

In conclusion

We saw from functional perspective all the previous requirement to configure the value mappings to obtain e-invoice document in Mexico will all the requirements needed by fiscal authorities, using the standard functionality of SAP S/4HANA Cloud. Please follow all the steps and follow our best practices to obtain the reach the goal in SAP S/4HANA Cloud.

Please feel free to contact me by direct message or an e-mail, thanks.

Labels:

25 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

API and Integration

1 -

Artificial Intelligence (AI)

1 -

Business Trends

361 -

Business Trends

58 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

456 -

Event Information

52 -

Expert Insights

109 -

Expert Insights

374 -

General

2 -

Governance and Organization

1 -

Great Britain

1 -

Introduction

1 -

Life at SAP

409 -

Life at SAP

6 -

Product Updates

4,633 -

Product Updates

476 -

Roadmap and Strategy

1 -

Technology Updates

1,491 -

Technology Updates

190

Related Content

- Withholding tax table taxable amount error in Enterprise Resource Planning Q&A

- SAP S/4HANA Business Partner Conversion – CVI_PRECHK - Tax Type XXX is not maintained for country YY in Enterprise Resource Planning Blogs by SAP

- Joule for SAP S/4HANA Private Cloud Edition - A Comprehensive Setup Guide in Enterprise Resource Planning Blogs by SAP

- Sales in SAP S/4HANA Cloud Public Edition 2408 in Enterprise Resource Planning Blogs by SAP

- Professional Services in the SAP S/4HANA Cloud Public Edition 2408 Release in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 12 | |

| 10 | |

| 7 | |

| 7 | |

| 5 | |

| 4 | |

| 4 | |

| 4 | |

| 4 | |

| 3 |