- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Intercompany Cost Allocations in S/4HANA Cloud

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

In this blog Sebastian Doll and I would like to show you the general process overview for intercompany cost allocations and the resulting periodic intercompany billing. In the first section we will explain the guiding principles to meet the related requirements of cost management, legal and group reporting. Then in the second section we will give an overview about the types of cost allocations, that are enabled for cross company postings, and we will analyze the generated journal entries. We will look at the configuration for clearing account determination. Finally in the third section, we will see how the cost postings are billed to the receiver company at period end. This blog is based on CE2005.

I. Overview and guiding principles of intercompany cost allocations in S/4HANA Cloud

Companies are intensifying their cooperative relationships in today’s global economy, for example by setting up shared services. As a consequence, intercompany cost allocations and billing processes are on the rise. As organizations become more global, it is becoming increasingly common for employees to charge time to a different legal entity. Especially professional service organizations are familiar with this situation, since they have consultants located across the world – as well as customer projects that are set up around the globe.

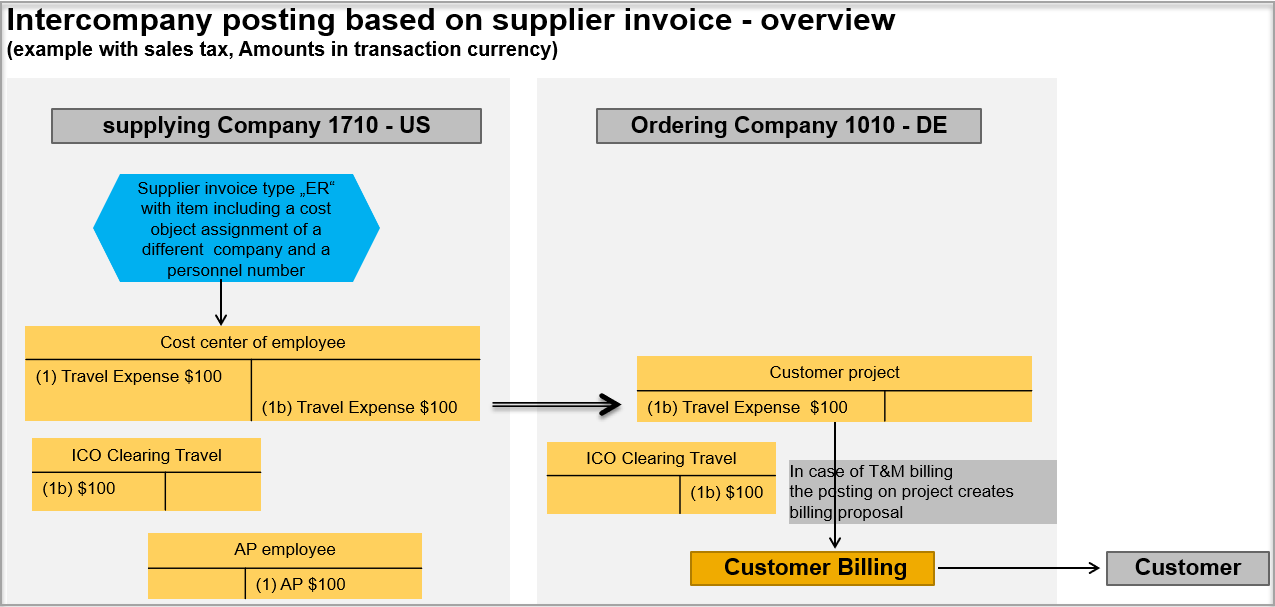

Let us present a process overview in figure 1.

A complete end-to-end intercompany CO allocation scenario consists of two parts: the intercompany cost posting and the periodic intercompany billing.

Figure 1: General overview for intercompany cost postings using the example of activity allocation

Figure 1: General overview for intercompany cost postings using the example of activity allocation

First, let’s have a look on the intercompany cost allocations. Compared to a scenario in which the costs are first collected in the supplying company and then periodically invoiced to the ordering company, direct cross-company posting has several advantages from a cost analysis perspective:

- The costs are immediately visible on the receiver. This is particularly essential in case on the receiver object runs a subsequent time and material billing, which can start immediately after for example time or travel confirmation.

- The direct intercompany posting provides much more detailed information on the receiver side. If the recipient is a customer project using resource-related billing, information such as the activity type, the service rendered date, the employee and the employee's note must be transferred, so that this data is available for the itemization of the billing document. The same applies to expenses recorded in Concur: here, the trip data is important for the project

- You can directly trace the costs of the receiver object back to the sender object.

- On the sender object you get the debit of the sending cost center with a link to the cost object in the other company code, which has the received the service

Thus, the intercompany cost posting covers the requirement for enhanced cost analysis – in both the sending and the receiving company.

However, no taxes are posted during the intercompany cost posting, nor revenues, receivables and payables. Hence, we need a second part: The intercompany billing. This is done as a periodic job based on the aggregated intercompany cost postings. The billing is done in reference to an intercompany sales order, with the receiving company as customer. Thus, based on the sales order the sending company (by sales organization) and the receiving company are determined.

The periodic intercompany billing process selects all CO journal entry items posted in the selected period.

Figure 2 shows an example based on T-accounts for this scenario

Figure 2: Postings of an intercompany activity allocation with margin

Guiding principles

In the upper section you see an example for intercompany cost allocations – here, time confirmation. For all intercompany cost allocations there is the same pattern provided:

- The ICO clearing accounts are P&L accounts and must not be a cost element (G/L account type = nonoperating Expense or Income), since no cost objects are available for these line items.

- In all 1a) and 1b) Journal entries a trading partner is filled: the cost postings balance to zero from a group reporting view. In these line items all detail information of the cost posting are available, like partner fields, personnel number and activity type.

- The intercompany cost allocations – posted with journal entry type “CC” - are relevant for controlling on sender and receiver cost object. In case of a customer project as the receiver, the reposted costs are recognized for time and material billing to customer and they will lead to a matching revenue recognition posting on the project based on the event-based revenue recognition.

- It is recommended to assign a separate intercompany clearing G/L account for each origin G/L account. This allows the assignment of the 1a) journal entry line items to the same financial statement node (the same of course for 1b)) so that those postings do not impact the financial statement.

This especially valid for the intercompany travel expense scenario: here, the travel expenses must be reported in the supplying company. The intercompany allocation must not reduce the amount of travel expenses in the supplying company and increase in the receiving company. - For the intercompany cost allocation in the supplying company, the sender object is a cost center (in the app “Reassign costs and revenues” there could be a different one). Receiver objects in the ordering company could be cost center, project (customer project, internal project and Mario project/EPPM project) or service order item.

Remark: with CE2011 the intercompany cost allocation to service order item are now taken in account in periodic billing too.

The periodic intercompany billing and subsequent AP posting in the lower section is necessary to cover all legal requirements

- The intercompany billing is done by a periodic job, which takes all intercompany cost postings of a selected period in account. (F1829 - “Generate Intercompany Billing request”)

- Here taxes are calculated and posted– if the company codes are not in the same tax group – based on the calculated affiliated revenues in supplying company and affiliated expenses in ordering company.

- The affiliated revenue and the affiliated expense G/L accounts are P&L accounts and impact the Financial statement!

There are no detail account assignments available as the billing line items are created on base of aggregated CO journal entries. - As Universal Journal profitability is active in Cloud, the affiliated revenues are posted against a profitability segment including the Debit Memo Request as attribute. Thus, the affiliated revenue G/L accounts need to be cost elements.

If you use cost elements for the affiliated expenses, you need to assign an automatic cost assignment (OKB9/ SSCUI ID 102639) as there are no detail account assignments provided.

Remark: there may be differences in the value between the affiliated revenues and the intercompany cost allocations, visible on the intercompany clearing accounts, in a given period – even the billing is based on the allocated amounts and there is no additional price calculation in place.

In addition to possible shifts in periods, these are mainly currency differences. The intercompany billing selects the costs based on transaction currency. The amounts are converted to the billing currency and company currency if necessary. This is done with one currency date – by default the last day of the month. The single cost allocations are converted into company code currency with every single posting date. For more see note 537556

Reporting

Let’s take a look at a few aspects of how intercompany bookings are represented in cost accounting and legal reporting.

In the travel scenario, the expenses on the cost center balance to zero due to the credit of the intercompany reposting.

In the income statement the travel expenses remain visible because the intercompany clearing account is included in the same financial statement node. The expenses are offset by the affiliated travel revenues.

With the intercompany activity allocation, the cost center is credited with the activity quantity and amount – same as for an intracompany activity allocation. In addition, the cost center is credited by the margin amount. Since it is posted with its own G/L account, it can be applied flexibly in the cost center reporting via assigning it to used FSV or cost element group.

In the income statement, an activity allocation is balanced to zero in the case of an intracompany allocation. So that this also happens with intercompany postings within one company code, the intercompany clearing account needs to be included in the same financial statement node as the activity allocation G/L accounts. The affiliated revenues for time are posted with the periodic intercompany billing are offset by the original personal expenses posted per period on the cost center.

If the recipient of the intercompany activity allocation is a customer project that generates revenues, it may be a requirement that the revenues generated by this intercompany service can be allocated to the supplying company. You can use the functionality of the origin PC described in this blog: https://blogs.sap.com/2018/07/27/financial-accounting-for-customer-projects-in-sap-s4hana-cloud-part...

Relevant Scope items

3 scope items describe the processes mentioned here – distinguished by the business scenario

4AN - Intercompany Billing for Cross-Company Cost Accounting Postings

16T - Intercompany Processes - Project-Based Services

4AU - Intercompany Processes for Enterprise Projects

The content for the intercompany clearing accounts and the intercompany billing is activated with the project scenarios 16T and 4AU. If you use another Intercompany scenario - e.g. the concur scenario 1M1, with CE2005 you need to ensure one of them is activated.

Remark: the scope item 3ZB Billing of Costs Between Affiliated Companies is not part of the processes mentioned here. In this process there is no cross-company CO posting. The intercompany transaction is an intercompany billing – of collected costs in the sending company code.

Now let’s move on to the individual CO intercompany use cases.

II. Intercompany co business transactions

There are several business activities using intercompany CO postings: time confirmation or other type of activity allocation, amount-based cost allocation and travel cross company posting – e.g. with Concur.

Especially in professional service businesses intercompany staffing on customer project is very common. The consultants confirm their time and expenses accordingly. For the activity allocation a mark-up can be applied.

Let’s start with the activity allocation process.

Intercompany activity allocation/ time confirmation with mark-up

Within the scenario of intercompany activity allocation there is an option to apply additional markups.

The general overview is shown in figure 1 and the T-accounts in figure 2

The resulting journal entry line items are shown below in the app ”Display Line Items in General Ledger”.

This example reflects the time confirmation of Employee “John Consultant”, working in company 1710 (US), of one hour “T003 Platinum Consulting” to WBS element SWINT.1.1 in company 1010 (DE)

Figure 3: Journal entries of an intercompany activity allocation

Figure 3: Journal entries of an intercompany activity allocation

For more details about the option for creating separate intercompany rates, the posting logic and reporting, see this blog: https://blogs.sap.com/2018/07/24/financial-accounting-for-customer-projects-in-sap-s4hana-cloud-part...

Explanation of the posting example:

- All line items are posted on P&L accounts. As mentioned, the clearing accounts are non-operating expense accounts

- There are always two documents in each company: one for the activity allocation and one for the margin.

- The cost center 17101902 in company 1710 is credited and the WBS element SWINT01.1.1 in company 1010 is debited. In case the receiver is a customer project, revenue recognition will be executed on this project based on both postings – activity and margin posting.

- The reference document “12” in column 4 shows that all four documents are based on one source document: the time sheet entry (column 5)

- The quantity is only provided in the activity allocation posting – to prevent double quantities on the sending cost center and the receiving customer project for T&M billing

- The margin posting is posted with the same business transaction type RKL as the related activity allocation

- Before CE2002 the margin was posted with business transaction type KAMV. We changed this with CE2002 for two reasons: Firstly, to keep these two postings together. Secondly, when we posted with KAMV, it was not possible to distinguish margin postings from other amount-based cost allocations.

- To allow the bundling of the margin and related activity allocation in the Time & Material billing there is the unit of measure copied in the margin document with quantity zero – 0.000H - and the partner activity type “T003”.

- In addition, the personnel number and the WBS element are provided in the journal entries in the sending company. The WBS element is only attributed (not a real account assignment), but available for reporting. Therefore, it is possible in the sending company, to drill down on WBS elements to intercompany time and expense postings in the same way as for intracompany postings.

- The trading partner in the far right column shows that this document has a relation to another company and is relevant for group consolidation.

- Special requirement for stable intercompany prices is applied (currency rate independent). As seen in our example the intercompany cost rate in the supplying company (US) can be maintained in receiver company currency (here, it is EUR). We use this currency as the transaction currency. Hence, the receiving company is charged with a fixed intercompany cost rate – independent of currency fluctuations.

Now we come to intercompany CO postings in the context of concur expense reports.

Concur intercompany posting

In the Concur application, an employee can assign his expense report to a cost object (cost center or project) in a different company code.

The company code in which we post the expenses, tax and accounts payable (the employee liability), is derived from the employee master record.

To assign the expenses in the employee’s company, we derive the cost center from the employee master. (if there is no employee available for the expense report in Concur, a cost center needs to be derived and sent from concur)

If no cost center can be derived for an intercompany scenario, the posting will fail.

An overview of this scenario you can see below in figure 4

Figure 4: Overview of Concur intercompany expense report

Figure 4: Overview of Concur intercompany expense report

Now let’s have a look at the journal entries which were created in this example. Travel expenses are posted to the cost center of the employee. Within the same „Logical Unit of work“ there is a CO reposting document created - crediting employee cost center in company 1010 and debiting WBS element in company 1710. The trading partner is set for the CO posting line items only -> in group reporting view this reposting is balanced to zero.

Remark: If the receiver object is a customer project, there will be an additional revenue recognition document created with reference to the Concur document

Figure 5: Journal entries of an intercompany Concur posting

Figure 5: Journal entries of an intercompany Concur posting

Explanation of the posting example in figure 5:

Employee “Stefan Walz”, working in company 1010 (DE), creates an expense report of €100 to the customer project WBS element ICOTESTUS.1.1 in company 1710 (US)

The travel expense, tax and AP posting incur in the company of the employee -> company 1010. The travel expense is posted to the cost center of the employee (cost center assignment can be defined in employee master data).

The cost reposting is done with accounting documents with the journal entry type CC “Sec. Cost Cross Company”. The cost center of the employee is credited and the WBS element is debited. The trading partner is applied to these line items.

All journal entry line items are referenced to the same reference document (column 6) with the reference document type CTE(CONCUR) – see column 7.

For reporting purposes, we provide additional the personnel number and the WBS element on the P&L line items in the supplying company. The WBS element is only attributed (not real account assignment) but available for reporting. So, it is now possible in the sending company to drill down on intercompany expenses on WBS element in the same way as for postings within the same company.

Regarding tax:

- Tax is only relevant in the company of the employee: 1010. In the intercompany „CO“ line items – JE type CC - there is no tax indicator applied.

- Within the cost reposting there are two line items with expense accounts, which are tax relevant but don‘t carry tax indicator -> can be distinguished by Journal entry type „CC“

- Tax will be calculated within the subsequent intercompany billing – if the companies are not within a tax group

The transaction keys explain the type of financial posting: BUV (Clearing between company codes), HRP (Customer/vendor trip costs postings) and HRT (Trip costs postings, expense accounts)

Supplier invoice with intercompany account assignment

This scenario can be used for the integration of external 3rd party travel applications to S/4HANA cloud. For mass data integration the API for Supplier invoice can be used.

A supplier invoice cannot post items in different company codes!

The supplier invoice will be posted in the company code of the employee. We applied an automatic intercompany CO reposting document to get the costs on the object that was assigned by the employee.

Figure 6: overview of the intercompany supplier invoice scenario

Figure 6: overview of the intercompany supplier invoice scenario

How the scenario works:

- The user creates a supplier invoice with the app Create Supplier invoice or uses the API for supplier invoice for mass data handling with external travel application

- Special document type – e.g. “ER” - must be used

- Expense line item is assigned to WBS element. WBS element is assigned to a different company code

- Personnel number is mandatory

- With the transfer to Financial Accounting – not visible for the user on the UI - the expense line item is redirected to the cost center of the employee, which we get from the employee master

- We create a “CO reposting document” – crediting the cost center of the employee and debiting the WBS element of the supplier invoice account assignment

- This is done in one Logical Unit of Work with the invoice

- The same expense account of the supplier invoice is used

- Work item, personnel number and line item text are copied

- Special travel Intercompany clearing accounts should be used (see self config UI)

Let’s create an example in the system. We use the app Create Supplier Invoice, which is part of the role SAP_BR_AP_ACCOUNTANT

Figure 7: Example supplier invoice - header

Figure 7: Example supplier invoice - header

The process is controlled with the document type ER.

Figure 8: Example for supplier invoice – G/L item view

Figure 8: Example for supplier invoice – G/L item view

In supplier invoice item, the WBS element SW008.1.1 is entered, which is assigned to company code 1010. This entry is only allowed, when additional the personnel number is applied. From this entry we get the cost center, which is assigned to the same company code 1710 as the supplier invoice.

The item text “Hotel for workshop” will be copied in the CO reposting document and visible on the WBS journal entry line item.

Figure 9: Journal entries of an intercompany supplier invoice

Figure 9: Journal entries of an intercompany supplier invoice

In the upper section you see the AP postings of the supplying company 1710. Here the cost center of the employee is debited with the supplier invoice – line item 2.

In the section below the project is debited with by the CO reposting in company 1010

All postings refer to the supplier invoice – see column 4 reference document

The CO reposting is posted with a separate journal entry type CC and business transaction type RKU1. All four items are assigned to a trading partner.

Tax – here, sales tax – is only relevant in the company of the supplier invoice for its AP and expense line item. The intercompany CO posting is not relevant for tax.

The text is copied to the line item of the project in company code 1010 and thus available for time and material billing to customer.

The WBS element is attributed in the reposting CO documents in the supplying company to allow tracing. The real account assignment is defined by the field Object Type.

Intercompany cost allocation

You can allocate costs between company codes with the Reassign Costs and Revenues app. Possible use cases are intercompany allocation of travel or shared service costs.

Remark: You can also post intercompany expenses with the Post General Journal Entries app. But the companies need not to be in the same tax group, and the intercompany postings are not selected in the periodic billing.

This restriction does not apply to the Reassign Costs and Revenues app.

The app is part of the Overhead Accountant role.

Figure 10: Intercompany expense allocation with Reassign Costs and Revenues app

Figure 10: Intercompany expense allocation with Reassign Costs and Revenues app

You need to specify the allocation expense account. The sender cost center is assigned to company 1710 and the receiver WBS element is assigned to company 1010. You enter an amount in transaction currency.

When we save we get the journal entries below.

Figure 11: Journal entries of an intercompany cost reassignment

Figure 11: Journal entries of an intercompany cost reassignment

In the upper section you see the postings for the sending company code. The cost center is credited.

In the section below the project is debited with the expense account.

You see both journal entries are referenced to the CO document 200000103.

In all four documents, the trading partner is assigned.

With this scenario we finish the CO intercompany postings. We learned that the flexible definition of the intercompany clearing accounts is important for the financial reporting. So let’s have a look at this.

Definition of Intercompany Clearing accounts

There is a self-configuration UI available under the task Automatic Account Determination, which you can access with the BPC_Expert role.

Here you can assign different clearing accounts per origin posted P&L G/L account (view cluster FINSVC_CO_CCC - see note 2457163 ).

Figure 12: Self-service UI for intercompany clearing accounts

Figure 12: Self-service UI for intercompany clearing accounts

The assigned intercompany clearing accounts must be defined by the G/L account type “Nonoperating Expense or Income”.

Remarks to the account determination in the different processes:

- In the Concur scenario, the travel Expense account needs to be assigned to an intercompany clearing account in the customizing activity of figure 12. If there is no clearing account derived, you get an error with the transfer of the expense report to S/4HANA Accounting.

- For the other cost allocation scenarios (activity allocation, time confirmation, cost re-assignment) we read additional the configuration activity Accounting Intercompany Clearing Accounts ( figure 13), if nothing could be derived in the activity figure 12.

Here you can define only one G/L account for every company-company relationship. And the clearing accounts must be balance sheet accounts.

Note: If you use these balance sheet accounts, the intercompany posting has an impact on your financial statement and P&L. So you need to ensure that the posted expense G/L accounts are excluded for the intercompany billing – otherwise you would activate it twice. As with this posting there are no taxes applied, this would be only be an optional scenario if the companies are within one tax group.

Figure 13 Configuration activity Accounting Intercompany Clearing Accounts

Figure 13 Configuration activity Accounting Intercompany Clearing Accounts

Control of CO intercompany postings

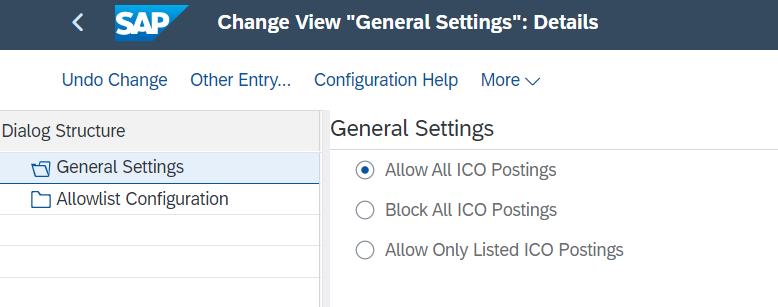

With CE2102 it's possible to control intercompany co postings for company code relationships via the SSCUI “Block Intercompany Postings” (ID 104056).

Figure B1 Configuration of blocking intercompany co postings

Figure B1 Configuration of blocking intercompany co postings

In the next step, you can allow or block all intercompany postings, or define an allowlist for certain combinations of sender and receiver company codes.

Figure B2 General settings for blocking ICO CO postings

If you work with an allowlist you can define for which company code relations ICO posting are allowed

Figure B3 maintaining allowed company code relations

Remark:This configuration is only relevant for co postings, not for G/L postings.

The following transactions/apps you can control:

- Time recording, timesheet postings/ Manage My Timesheet

- Activity allocation/ Manage Direct Activity Allocation

- The co posting within the Manual supplier invoice of type ER see above

- Expense posting through Concur integration

- Settlement

- CO assessments/allocations

- Overhead calculation, periodic and event-based

- Manual cost allocation

- Reassign Costs and Revenues

This Configuration will be available in OP with the 2021 Release. In OP the check is not active for the supplier invoice scenario and the Concur Intercompany posting.

With CE2102 the Note 2855105 , in which we in general restricted several ICO co postings, is obsolete.

This completes part one of the intercompany CO scenario. Now let’s move on to the third section, the periodic intercompany billing

III. Periodic Intercompany Billing

With the intercompany CO postings, some legal requirements are not yet covered. We are still missing taxes, accounts receivables and payables as well as affiliated revenues and expenses for group reporting. This is provided by the periodic intercompany billing, which we will explain in the following chapter step by step.

Creation of intercompany sales order

For every company-to-company relationship a sales order is required – as basis for the intercompany billing document.

It can be created with the app Create Sales Order Intercompany, which is part of the role SAP_BR_INTERNAL_SALES_REP_PRSV.

Figure 14: Creation of an intercompany sales order

Figure 14: Creation of an intercompany sales order

The assigned customer “10401010” represents the receiving company. There is a separate sales order document type SO03 and a separate item category PS04 for intercompany. There is only one item required, to which an intercompany Time and Material Billing profile is assigned.

CO documents are base for intercompany billing

The basis for the intercompany billing are the CO journal entry postings. Below we see the CO intercompany postings, which are relevant for an intercompany billing from company 1710 to 1010 for April 2020: they are posted in company code 1010 with trading partner 1710..

Figure 15: Intercompany postings for a certain period

Figure 15: Intercompany postings for a certain period

Creation of intercompany billing document

The periodic intercompany billing is done by the app Generate Intercompany Billing Request, which is part of the role SAP_BR_INTERNAL_SALES_REP_PRSV – see figure 16.

Figure 16: Request for periodic intercompany billing

Figure 16: Request for periodic intercompany billing

The billing is created with reference to intercompany sales order 16152 shown above.

By selecting Save sales document, a subsequent Debit Memo request is created.

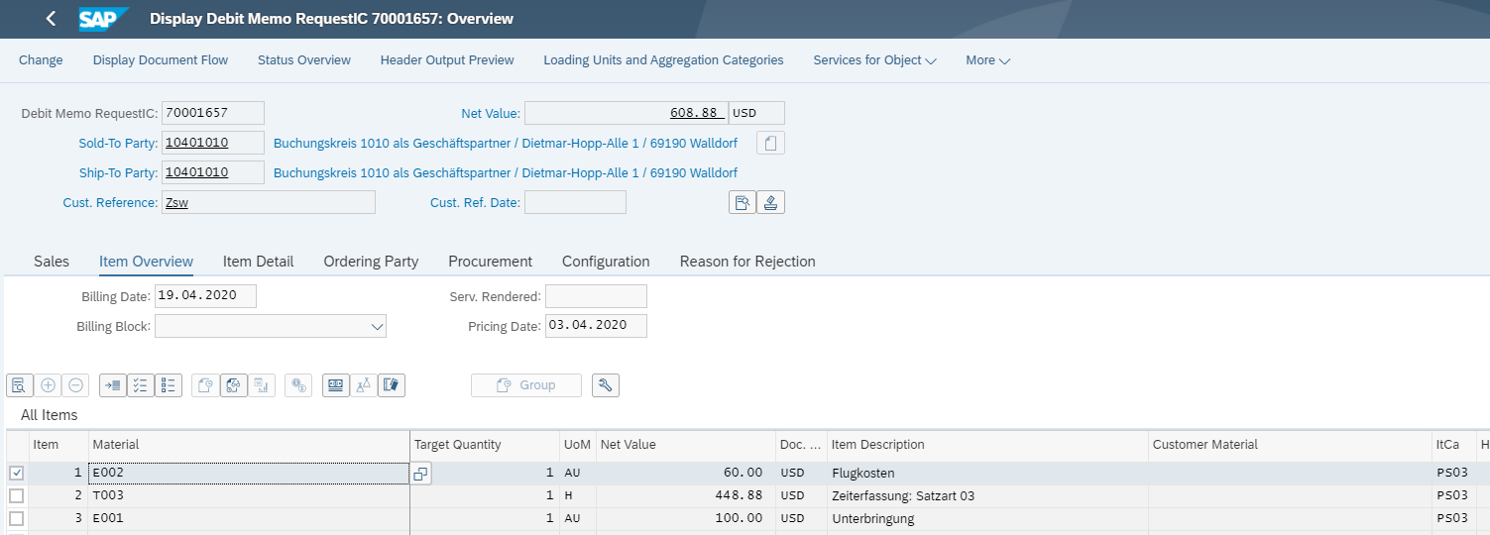

Figure 17: Intercompany debit memo request

Figure 17: Intercompany debit memo request

In the DMR there are line items created by the different sources – here two items for different expense types and one for the times. Basis for this billing proposal are the postings in figure 15.

- There is a billing product “E002” derived for the six travel postings on G/L account 61007000 with a value of 60 USD

- There is a billing product “E001” derived for the one travel posting on G/L account 61003000 with a value of 100 USD

- There is a billing product “T003” derived for the time confirmations with a value of 448,88 USD.

The matching CO postings show a value for the time confirmation of 400 EUR in transaction currency, which is converted to 495,20 USD in company code currency.

Here we get an example for different values based on different currency rates.

Figure 18 explains the pricing for the time confirmation

Figure 18: Pricing for the intercompany time confirmations

Figure 18: Pricing for the intercompany time confirmations

The aggregated time confirmation costs based on transaction currency of the intercompany postings are 400 EUR. The 400 EUR are converted with one currency date – 30.4.2020 – to 448,48 USD.

With reference to the DMR the invoice is created

Figure 19 the intercompany Invoice

Figure 19 the intercompany Invoice

There is a separate intercompany invoice type CI02 used for intercompany billing

Below you see the accounting document of the invoice.

Figure 20: Journal entry for the intercompany invoice

Figure 20: Journal entry for the intercompany invoice

There is a detailed invoice document available, which lists the individual intercompany CO postings.

Figure 21: Output document for the intercompany Invoice

Example for and intercompany AR posting with the matching AP document created by IDOC

Let us show you an example for the journal entry for the AR invoice and the matching AP document.

This example is different to the example above.

Figure 22: Example for an intercompany AR posting

Figure 22: Example for an intercompany AR posting

With IDOC the corresponding AP Document in the receiving company code is created:

Figure 23: Example for a matching intercompany AP posting

Remark: To get an account assignment for the expense posting in the receiver company code, created by IDOC, you need to maintain a receiver cost object in the app Default Account Assignment for the expense G/L account. Otherwise you get an error in the IDOC AP posting.

Reflection of intercompany co postings in periodic billing

Please note: with S/4HC 2011 postings on a service document as receiver are now recognized in intercompany billing too.

To include in OP additional co transactions - like co settlement - in the periodic intercompany billing please check Note 1447123

Summary

We hope you enjoyed this overview of Intercompany CO allocations and its subsequent intercompany billing. The CO allocations allows for the receiver detail information on line item level and a perfect tracing for the intercompany activities, while the legal billing is done aggregated at period-end. We plan to enhance the scenarios on roadmap as these scenarios are more and more used by customers - especially shared service allocations. We will keep you updated.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

29 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

27 -

Expert Insights

114 -

Expert Insights

181 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,682 -

Product Updates

261 -

Roadmap and Strategy

1 -

Technology Updates

1,500 -

Technology Updates

97

- Why YCOA? The value of the standard Chart of Accounts in S/4HANA Cloud Public Edition. in Enterprise Resource Planning Blogs by SAP

- Advanced WIP reporting in S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- S4 HANA Cost Center Activity Rate Calculation Hybrid Approach in Enterprise Resource Planning Blogs by Members

- Continuous Influence Session SAP S/4HANA Cloud, private edition: Results Review Cycle for Q4 2023 in Enterprise Resource Planning Blogs by SAP

- Professional Services in the SAP S/4HANA Cloud Public Edition - The Collection in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 10 | |

| 6 | |

| 5 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 | |

| 3 | |

| 2 |