- SAP Community

- Products and Technology

- CRM and Customer Experience

- CRM and CX Blogs by Members

- Integration of Avalara for U.S Tax Calculation

CRM and CX Blogs by Members

Find insights on SAP customer relationship management and customer experience products in blog posts from community members. Post your own perspective today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

joshuasamson

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

05-11-2023

9:06 AM

With the new release of Feature Pack 15 for SAP Customer Checkout the integration of Avalara for U.S tax calculation has been enhanced to make life easier when integrating Avalara into CCO.

New Features have been added aswell.

The following Blog will give you an overview about some of the new features:

When integrating Avalara in SAP Customer Checkout Feature Pack 15 the destination of Avalara is now already preconfigured and only username and password of you Avalara account have to be filled, making the integration quicker and saving time and cost.

In the communication arrangement tab of SAP Customer Checkout manager you can see a list of services provided by the Avalara integration for SAP Customer Checkout.

In the U.S sytstem you will not find a "Taxes" tab as it is working with Tax hint codes. These tell Avalara which tax code is relevant for a certain article based on the tax of the respective region the article has been orderen in. For example a water has a certain tax in California but has a different one in New York.

When creating a receipt in the POS system you will see a subtotal of the articles without tax. When "Proceed to payment" is clicked it is sent to Avalara which calculates the tax according to the region.

After the receipt has been created you can see whether the Avalara Tax Calculation was successful or not in the "Dispatch states" tab of the receipt.

When entering the shipment information you can either select it manually or select a customer and copy the shipment information of the customer to the receipt. Avalara then validates the shipment address and also gives a suggestion for a more precise address if there is one.

The tax amount will then change according to the region of the shipment address.

For further information about the new features of SAP Customer Checkout Feature Pack 15 please visit: https://partneredge.sap.com/en/library/assets/products/cust_mng/dgl/27/02/SAP952702.html

New Features have been added aswell.

The following Blog will give you an overview about some of the new features:

- Generated destination for Avalara communication system

- Maintaining tax codes in the article creation

- Address validation with Avalara

Generated destination for Avalara communication system

When integrating Avalara in SAP Customer Checkout Feature Pack 15 the destination of Avalara is now already preconfigured and only username and password of you Avalara account have to be filled, making the integration quicker and saving time and cost.

Avalara pre-configured destination

In the communication arrangement tab of SAP Customer Checkout manager you can see a list of services provided by the Avalara integration for SAP Customer Checkout.

Avalara Outbound services

Maintaining Tax Codes in the article creation

In the U.S sytstem you will not find a "Taxes" tab as it is working with Tax hint codes. These tell Avalara which tax code is relevant for a certain article based on the tax of the respective region the article has been orderen in. For example a water has a certain tax in California but has a different one in New York.

Article creation

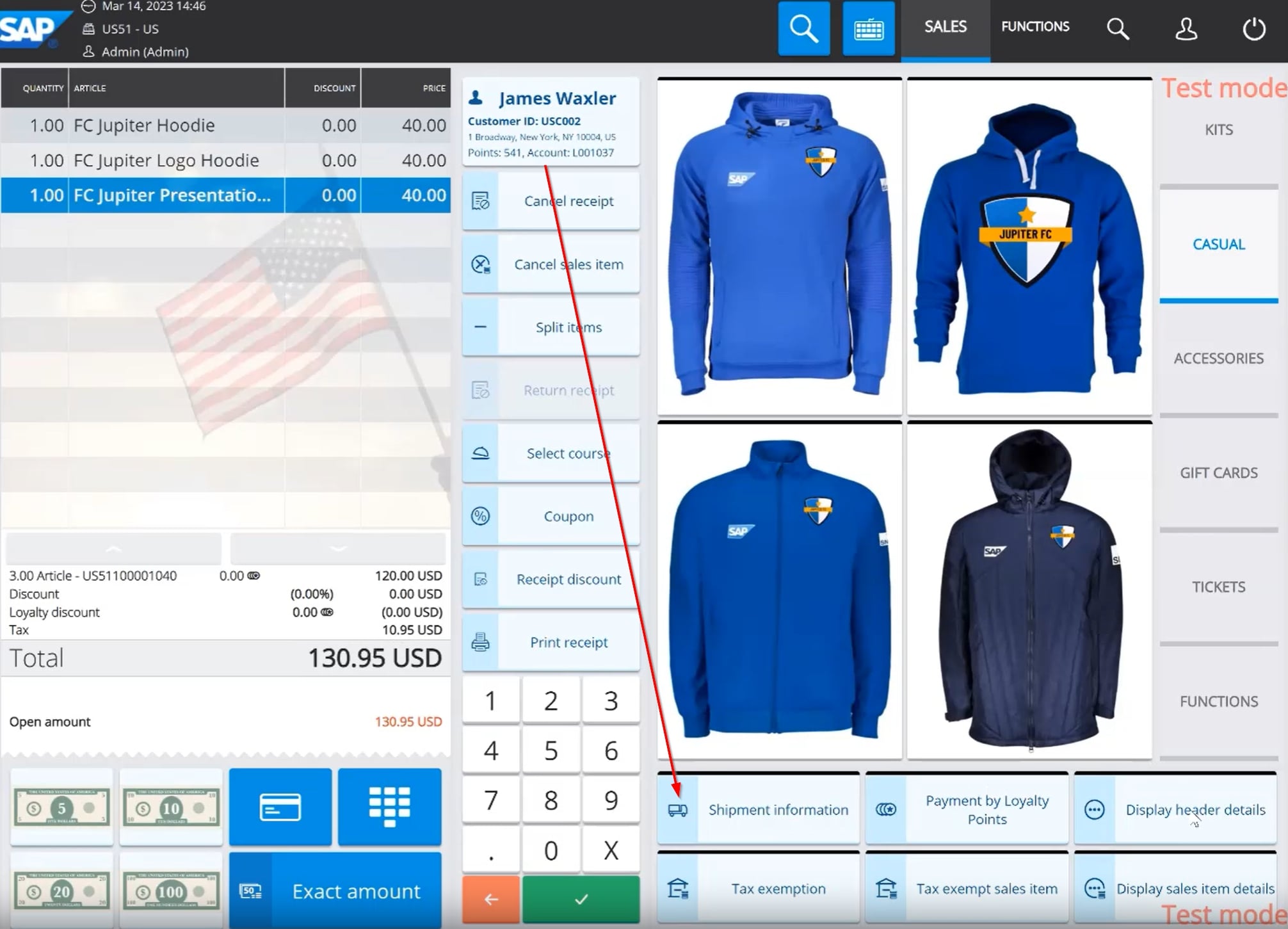

When creating a receipt in the POS system you will see a subtotal of the articles without tax. When "Proceed to payment" is clicked it is sent to Avalara which calculates the tax according to the region.

Receipt before Avalara Tax Calculation

Receipt after Avalara Tax Calculation

After the receipt has been created you can see whether the Avalara Tax Calculation was successful or not in the "Dispatch states" tab of the receipt.

Address Validation with Avalara

When entering the shipment information you can either select it manually or select a customer and copy the shipment information of the customer to the receipt. Avalara then validates the shipment address and also gives a suggestion for a more precise address if there is one.

The tax amount will then change according to the region of the shipment address.

For further information about the new features of SAP Customer Checkout Feature Pack 15 please visit: https://partneredge.sap.com/en/library/assets/products/cust_mng/dgl/27/02/SAP952702.html

- SAP Managed Tags:

- SAP Customer Checkout

1 Comment

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

ABAP

1 -

API Rules

1 -

c4c

1 -

CAP development

2 -

clean-core

2 -

CRM

1 -

Custom Key Metrics

1 -

Customer Data

1 -

Determination

1 -

Determinations

1 -

Introduction

1 -

KYMA

1 -

Kyma Functions

1 -

open SAP

1 -

RAP development

1 -

Sales and Service Cloud Version 2

1 -

Sales Cloud

1 -

Sales Cloud v2

1 -

SAP

1 -

SAP Community

1 -

SAP CPQ

1 -

SAP CRM Web UI

1 -

SAP Customer Data Cloud

1 -

SAP Customer Experience

1 -

SAP CX

2 -

SAP CX Cloud

1 -

SAP CX extensions

2 -

SAP Integration Suite

1 -

SAP Sales Cloud v1

2 -

SAP Sales Cloud v2

2 -

SAP Service Cloud

2 -

SAP Service Cloud v2

2 -

SAP Service Cloud Version 2

1 -

SAP Utilities

1 -

Service and Social ticket configuration

1 -

Service Cloud v2

1 -

side-by-side extensions

2 -

Ticket configuration in SAP C4C

1 -

Validation

1 -

Validations

1

Related Content

- What is planned for the 2405 release of SAP Variant Configuration and Pricing? in CRM and CX Blogs by SAP

- SAP Commerce Cloud Q4 ‘23 Release Highlights in CRM and CX Blogs by SAP

- How to create and run unit test in SAP Commerce Cloud in CRM and CX Blogs by SAP

- What is planned for the 2402 release of SAP Variant Configuration and Pricing? in CRM and CX Blogs by SAP

- SAP Customer Checkout 2.0 Feature Pack 18 Now Available in CRM and CX Blogs by SAP