- SAP Community

- Products and Technology

- Financial Management

- Financial Management Blogs by Members

- Bank Reconciliation Accounts

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

- SAP Managed Tags:

- Treasury Management,

- SAP Treasury and Risk Management,

- FIN Treasury

In latest versions of SAP S/4 HANA, SAP gives us the opportunity to use reconciliation bank accounts. This way, a single G/L account can be assigned to multiple bank accounts. This option definitely help us reduce the number of accounts we usually used for bank accounting.

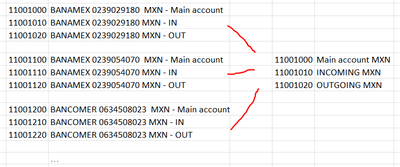

Let's see this, in the past for each bank account we needed a G/L account and at least two auxiliary subaccounts, for example

- GL account 11001000 - balance sheet account (assigned to each house bank account)

- GL account 11001010 - clearing G/L accounts for income

- GL account 11001020 - clearing G/L accounts for expenses, of course we can have more clearing accounts if we wanted to separate by payment method, for example one for checks, etc.

So, if our client had 10 bank accounts, we had to create 30 GL accounts. Now, it is no longer necessary, we only need to use one set of GL accounts, for this example, only 3, for all the bank accounts we have in the same currency.

How is this? How does it work?

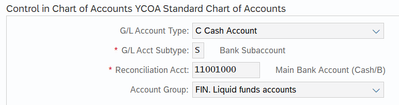

First of all, the definition of accounts in the Chart of accounts has a couple of additional settings to inform the system which our main account is(balance sheet account), and which the auxiliaries or subaccounts are (clearing accounts). You can see this, in the following images, the additional settings are G/L account type: C-Cash account, and G/L account subtype: B-Bank Reconciliation account.

Settings for our main bank account:

or S-Bank Subaccount, also you need to specify here its Reconciliation account (the main bank account).

This is our subaccount:

Now, how does the system know when I post an accounting document, which bank account I want to affect? or, when I want to see the balance of the reconciliation, which bank account is that balance from?

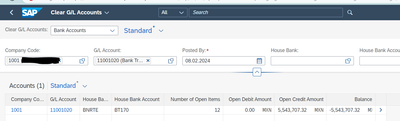

To control these type of G/L Accounts, all SAP fiori apps will require house bank and bank ID as mandatory fields when you use a Bank reconciliation account. In this way, if you post a manual payment, you must enter the GL account (main bank account), in addition to house bank and bank ID, this is the same if you want to clear one of the subaccounts or when you want to post bank statements. Look at the following pictures:

And what about the automatic payment configuration?

In the past we needed to specify the clearing G/L account for outgoing payments, not anymore. Now, we just need to specify the payment method, house bank and ID account, as you can see in the following image.

This is possible because, now we need 2 additional configurations to complete this process.

The first new configuration (in outgoing payments) is that instead of assigning the G/L account to the payment method, we need to assign an Account symbol, like this:

And the second customizing is that this Account symbol needs to be customized in Electronic bank statement customizing. There we assign the GL account to the account symbol. (see images)

Finally, with the creation of bank accounts, (master data) we will have the full scenario ready to use it in payments or Electronic bank statements.

Create bank accounts in Manage bank accounts fiori app. Here, we will need to specify, company code, bank, id, and the most important the connectivity to GL, here we will put the main GL account.

This is all for now.

"The most beautiful thing we can experience is the mysterious. It is the source of all true art and science". - Albert Einstein

Related links:

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

2023 Upgrade

1 -

Access Control

1 -

Accounting

1 -

Accounting & Financial Close

1 -

Accounting and Financial Close

1 -

Asset acquisition via BAPI_ACC_DOCUMENT_POST

1 -

Asset Impairment Asset Revaluation Configuration

1 -

Assets

1 -

Assign Missing Authorization Objects

1 -

Bank Reconciliation Accounts

1 -

BAPI

1 -

BRIM SAP S4 HANA Service Subscription Order Management Process Flow

1 -

CLM

2 -

cloud security

1 -

consolidation

1 -

cybersecurity

1 -

EAM

1 -

Emergency Access Management

1 -

End to end Configuration for Project Interest calculation

1 -

EWZ5

1 -

EWZ6

1 -

FFID

1 -

FI-AA

1 -

FIN Asset Management

1 -

FIN-CS

1 -

Finance

3 -

GRIR

1 -

Group Reporting

1 -

groupreporting

1 -

GTS Edition for Hana Retired tables and replacement

1 -

IFRS16

1 -

IFRS16 ROU

1 -

Invoice Printing Lock

2 -

management

1 -

Mapping of Catalog & Group

1 -

Mapping with User Profile

1 -

matching concept and accounting treatment

1 -

Parameter 4026

1 -

Payment Batch Configurations

1 -

Predictive

2 -

Predictive Planning

1 -

Project Interest calculation in Investment project

2 -

Public Cloud

1 -

REFX

1 -

Revenue Recognition

1 -

review booklet

1 -

Risk management

1 -

RSUSR_LOCK_USERS

1 -

S4 HANA

1 -

S4 HANA 2022

1 -

S4 HANA On-Premise

1 -

s4hana

1 -

SAP BRIM

1 -

SAP CI

1 -

SAP ECC

2 -

SAP FICO

1 -

SAP RAR

1 -

SAP S4 Hana

1 -

SAP S4HANA

1 -

SAP s4hana cloud

1 -

SAP S4HANA Cloud for Finance

1 -

SAP Security

2 -

SAP Treasury and Risk Management

1 -

SAP Treasury Hedge Accounting

1 -

Security

2 -

Security by Default

1 -

Security by Design

1 -

Update Reference Field Of Payment Document

1 -

Z Catalog

1 -

Z Group

1

- Clear open items by leveraging ICMR documents matching capability in Financial Management Blogs by SAP

- Leverage ICMR to clear the GL account open items in Financial Management Q&A

- "Bank Accounts (Enhanced)" settings in the FBZP in Financial Management Q&A

- MIRO: Planning level taken from the reconciliation account instead of the planning group. in Financial Management Q&A

- Asset Impairment / Asset Revaluation Configuration - SAP S4Hana in Financial Management Blogs by Members