- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Retro-Billing SD (VFRB)

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Applies to

SAP ECC; Sales and Distribution; Billing.

Summary

Retro-billing is a process of issuing credit or debit memos after retroactive price adjustments

Created on

07 May 2013

Author(s)

Jyoti Prakash

Author Bio

Jyoti Prakash is SAP Certified Associate and works as Senior Resource for Order Management & After Market. Currently, focused in providing consulting services to their customers for support project on SAP Order Management, After Market, Project System, and Logistics Execution.

Table of Content

- Introduction

- Overview

- Prerequisite for using on Retro-Billing

- Billing Document for Retroactive pricing adjustment

- Condition record

- Order Reasons

- How Retro-Billing works on SAP

- Invoice & condition record - Existing

- Condition Record - Change

- Executing of Retro-Billing

- Related Content

1. Introduction

Out of those various business processes in billing is accommodates & reconciliation of the retroactive prices adjustment for number affecting existing invoices. The retroactive prices adjustment can be due:

- Strong bargaining power of customer over

- New pricing agreement between supplier

- Volatile/change is price of essential commodities for manufacturing

to name a few.

This kind of prices adjustment can be handled by Retro-Billing. For instance, a new pricing agreement that you agreed with your customers may affect billing documents that have already been processed and settled. If that pricing agreement is effective before the pricing date of the billing documents, you can perform retroactive billing to call up a list of these documents and revaluate them with the new price. You can then create additional billing documents to settle any differences.

So, by definition & example of retro-billing, it can have a life cycle of months or sometimes beyond a year. Therefore this makes it a unique process.

2. Overview

Figure 1. Retro-Billing Process

On 01.03.2011, Supplier ships & sells 10 units of Material ABCD to Customer XYZ for INR 58 per unit (valid from 01.03.2011 to 31.12.9999), total amount INR 6653.30.

On 02.03.2011, invoice is sent to Customer for INR 6653.30.

Now on 01.07.2011, due to negotiations price may change to INR 68 w.e.f. 01.07.2011 (valid till 31.12.9999). Thus you will update your condition type in TCode VK11 / VK12 for this Material ABCD & Customer XYZ to INR 68 with validity from 01.03.2011 to 31.12.9999. But as you have already invoiced the customer in past so, to take care of this retroactive price adjustment you have an extra billing.

So, standard SAP platform provides the retro-billing transaction VFRB. This transaction provides basic retro-billing functionality enabling identification of invoice documents affected by retroactive price changes and execute creation of multiple documents.

In Retro-billing, enter the selection criteria like Payer, Sales Organization, Billing date from & to, Pricing type, Currency, Sold-to Party & Material.

By this system will provide you the list of invoices to which this retroactive price changes is applicable and hence you can simulate or even execute retro-billing & system will accordingly generate Credit/Debit memo type based on differential amount.

For positive retroactive price changes, i.e., INR 10 per unit price from former as INR 58 & revised as INR 68. In this case system will generate Debit Memo for the differential amount to be collect receivable from Customer. Whereas, for negative retroactive price changes, i.e., INR 15 per unit price from former as INR 58 & revised as INR 43. For this case system will generate Credit Memo for the differential amount to be pay back the differential amount to Customer.

These documents will get be in document flow of the original invoices.

3. Prerequisite for using on Retro-Billing

A. Billing Document for Retroactive Pricing Adjustment

- Retro Debit Memo

- Retro Credit Memo

- Corresponding relevant Copying Control

- Pricing procedure for capturing price change

B. Condition Record

- The value for base price should determined automatically in the invoice through condition record

- It should be maintain on the bases of Material & Customer combination

- It should be a have valid validity from & to date

C. Order Reasons

You need to maintain proper order reasons specific to retro billing document type for Credit/Debit memo.

4. How Retro-Billing Works on SAP

A. Invoice & Condition Record - Existing

You can use TCode VF05N for list of billing documents or invoices based on

- Billing Document Date (to & from)

- Billing Type,

- Customer & Payer,

To view desired invoices with current base prices use TCode VF03.

In invoice, check item data – condition tab to view pricing.

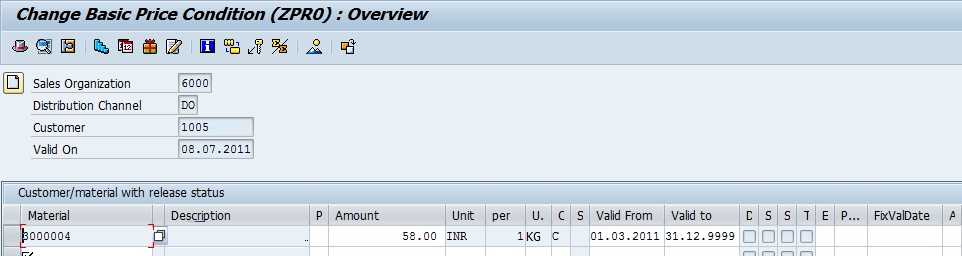

In the invoice, to view corresponding maintained condition record for condition type, say, ZPR0. Selecting the condition type and click on  button to view the maintained condition record.

button to view the maintained condition record.

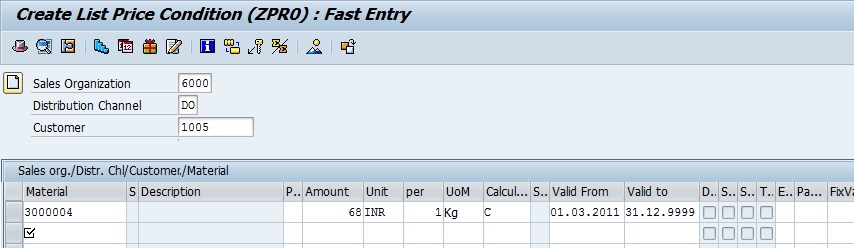

B. Condition Record - Change

For changing in the existing condition record for base price condition type use TCode VK12. Choose key combination as Customer/Material.

Provide the desired parameter for execution the condition records.

Maintain the change in price difference. Say, positive difference of INR 10 from former price INR 58 and revised price INR 68.

C. Executing of Retro-Billing

Use TCode: VFRB for exercising retro-billing option. Provide following parameter based on your requirement, but keeping mandatory fields in mind:

- Payer (Mandatory)

- Sales organization(Mandatory)

- Billing date from(Mandatory)

- Billing date to (Mandatory)

- Pricing type(Mandatory)

- Currency(Optional)

- Sold-to party(Optional)

- Material (Optional)

You have a option of include Invoices with the Same Net Values. This indicator defines whether invoices whose current net value is the same as the post-calculated net value should be included in the retro-billing list.

- If the indicator is set, invoices with the same prices are included.

- If the indicator is not set, invoices with the same prices are not included

For instance, Invoice was created with a price of 100 Units. After the unit price is reduced to 50 Units, the retro-billing list is used to create a coupon for 50 Units. If you discover later that this price reduction was incorrect and you set the price back to 100 Units, a retro-billing list only appears if this indicator is set.

Below you can find details of entries without error

![]()

Select the desire invoice/invoices for the list of entries without error and click on  button for simulation run.

button for simulation run.

Then following screen will appear for simulation run.

For generating Retro Debit/Credit memo click on  button.

button.

You can click on  button for viewing the generated retro billing. Green indicator confirms that the document generated without any

button for viewing the generated retro billing. Green indicator confirms that the document generated without any

errors.

Subsequently you can view the generated Debit memo from retro billing by using TCode VF03.

5. Related Content

- SAP Library: Retro-Billing

- SCN Message ID 9537098: Retro Billing - Normal Sales Process

- SCN Thread ID 874041: Retro Billing

- SCN Thread ID1793527: Retro-Active Billing - Config. Guide

- SCN Discussion Retro-billing Pricing

- SAP Note 1263240 - VFRB: Performance during mass processing

- SAP Note 81382 - Notes on the retro-billing list with examples

Disclaimer and Liability Notice

This document may discuss sample coding or other information that does not include SAP official interfaces and therefore is not supported by SAP. Changes made based on this information are not supported and can be overwritten during an upgrade.

SAP will not be held liable for any damages caused by using or misusing the information, code or methods suggested in this document, and anyone using these methods does so at his/her own risk.

SAP offers no guarantees and assumes no responsibility or liability of any type with respect to the content of this technical article or code sample, including any liability resulting from incompatibility between the content within this document and the materials and services offered by SAP. You agree that you will not hold, or seek to hold, SAP responsible or liable with respect to the content of this document

- SAP Managed Tags:

- SAP ERP,

- SD (Sales and Distribution),

- SD Billing

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

abap cds

1 -

ABAP CDS Views

1 -

ABAP CDS Views - BW Extraction

1 -

ABAP CDS Views - CDC (Change Data Capture)

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

API and Integration

1 -

Approval Workflows

1 -

Ariba

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

CDS Annotations

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Customizing

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

2 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

3 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Employee Central Integration (Inc. EC APIs)

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

How to add new Fields in the Selection Screen Parameter in FBL1H Tcode

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

Ledger Combinations in SAP

1 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

mm purchasing

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

POSTMAN

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

purchase order

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

S4HANACloud audit

1 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP CI

1 -

SAP Cloud ALM

1 -

SAP CPI

1 -

SAP CPI (Cloud Platform Integration)

1 -

SAP Data Quality Management

1 -

SAP ERP

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Subcontracting Process

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

Sourcing and Procurement

1 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

Time Management

1 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- New Pricing procedure required in retro billing target document in Enterprise Resource Planning Q&A

- Retro Billing -Document flow in Enterprise Resource Planning Q&A

- VFRB: credit memo request in Enterprise Resource Planning Q&A

- How to modify calculation of PDIF Condition type in Retro? in Enterprise Resource Planning Q&A

- Retroactive Billing - VFRB Modification to add credit/debit line in Enterprise Resource Planning Blogs by Members

| User | Count |

|---|---|

| 7 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |