- SAP Community

- Groups

- Industry Groups

- SAP for Insurance

- Blogs

- Simple Insurance... are we there yet?

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

- SAP Managed Tags:

- Insurance

“Run Simple” has been a very catchy phrase since its inceptions as SAP’s new theme which rolled out at its annual SapphireNow user conference in Orlando as a brand message SAP adopted way back in June 2014. A very good strategy adopted by SAP to convey its message to its existing customers and to attract potential customers. This gave brownie points and an edge over its competitors I must say and it works and works quite well! Everyone loves it.

Now comes the not-so-simple part, different core application in SAP for Insurance. In the “SAP for Insurance” world we have this value map which demonstrates how different core processing application modules like FS-QUO, FS-PM, FS-CD, ICM (cross industry solution), FS-CM, and FS-RI can be used to take care of Core Insurance Operations. This is the current landscape model which is being projected as Customer Centric model.

This Customer Centric model having different core insurance application, has certain limitations;

- Complex landscape – if you notice the applications are based on the life-cycle of an Insurance policy. For an Insurance policy each application component kicks in depending upon the stage of the insurance policy.

- Data footprint is large as there is header and detailed table structure of the database. Data models of each application have a varied design.

- No Real-time processes – Data has to be pushed or pulled through different applications.

- Batch jobs take extensive time to complete. Failed batch jobs are a night mare for Insurers.

- Data replication, duplication, aggregates are common because of the complex landscape.

Simple Insurance – A new vision

This Customer Centric model can be remodeled to make SAP for Insurance, simple. Now we have a new catch line “Simple Insurance”.

How can this Simple Insurance model be structured? I want this model to be as simple as it sounds and which suits the title Simple Insurance. I want the best of what the entire existing SAP core insurance applications have in a single carton based on real-time analysis of financial and operational business scenarios. ERP-system-from-scratch for different SAP Insurance components (and then putting in time and resources to integrate them) is a Big No.

Here is what simple Insurance should be devised of, and what every Insurers would prefer to have;

- Simpler landscape with less interfaces to other SAP/ Non SAP system components.

- Smaller data footprint when it comes to management of data.

- Real-time processes across life-cycle of a policy. In short don't have to depend upon internal interfaces as the unified architecture takes care of this.

- No hassles related to batch jobs / time and resource consuming batch jobs.

- No data replication, no duplication and no aggregates.

What the Insurers are looking for are;

From user’s perspective

- Simple administration – Customers and Insurers are interested in having a user manage the entire life-cycle of a policy of a customer at different stages. The user with minimal systems training can be trained for this to take care of complex requests rather than the current trend of imparting specialized training to users to handle complex request where they can handle only certain stages of the life-cycle of the policy. If the simple insurance landscape allows this then customer service touch point provided can close the gap between the customer/ policyholder and the Insurer.

- Simpler user experience - For both the online customer and the Insurer. No one wants to run door to door to get their requests attended / queries answered or attended to. Instead a single window to handle such things is very much convenient. In the same way no one would prefer to navigate to different SAP applications to get things done. It would be wonderful to have a single window which is much user friendly rather than referring to some t-code cheat sheet or having to access various links to different SAP components.

From IT management perspective

- Simple to implement – Minimal use of tools to guide and configure the application. And less time to go live.

- Simpler development – From an IT management perspective, usually an enhancement in one of the core applications triggers enhancements in other dependent SAP core application(s). Each of these core applications being at a different version of enhancement pack makes the whole IT development process crumble some.

Here is what the modern SAP Insurance landscape would look like with HANA for real time analysis;

“Simple Insurance” can be modeled as shown below by having a simple architecture where we have core systems acting as a unified application.

For e.g.; we have this SAP Policy Management (FS-PM) where the Insurer can control the whole life cycle of a contract policy, starting from the creation of an application, through policy issuance and ongoing contract maintenance, and up to the termination of the contract with the Insurance customer.

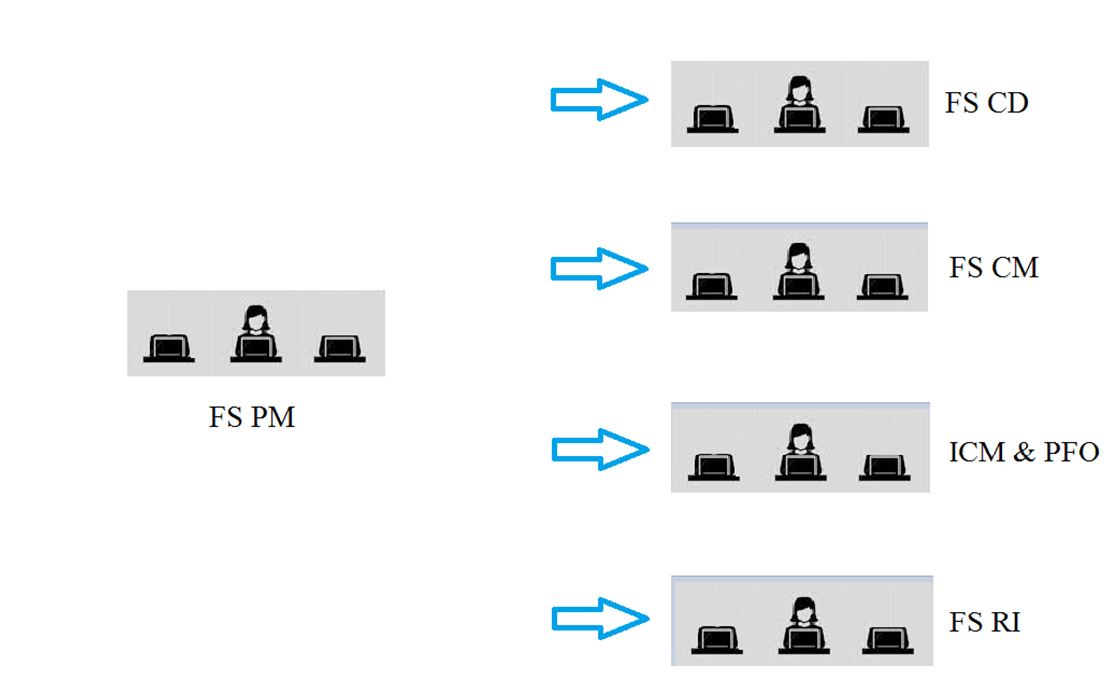

For this SAP Policy Management (FS–PM) provides interfaces for the integration of other SAP Insurance components. Taking some of the SAP components which are mentioned below as an e.g.:

- Collections and Disbursements (FS-CD)

- Claims Management (FS-CM)

- Incentive and Commission Management (FS-ICM) and Portfolio Assignment (PFO)

- Reinsurance (FS-RI)

Now these SAP Insurance components have their own architecture to manage the respective Insurance business process with its own database. It is like the Insurer has to implement each SAP insurance components as a separate ERP. In the figure below I have just considered FS-PM’s interfaces to the other main SAP insurance components while there can be many and with non SAP systems as well.

The Simple Insurance architecture can be modeled to move from this architecture to a more simplified and robust architecture which shall meet with the consistently improving infrastructure ( like in memory based computing and database), and also use scalable options that can help Insurers meets future requirements.

This simple insurance architecture can portray as single ERP and face to the Insurer. This can be achieved by having a single component as shown below.

As the first step towards this simplicity, the core SAP insurance components can be concentrated upon and then the other SAP components like Finance and Risk, Procurement, HR & Investments can be looked at. Integration with the Cloud based solutions shall be an additional bonus.

Right now the concept of Simple Insurance is just an idea which Insurers would like to see as a reality in the future. Thus making the concept of having various complex SAP components knit together redundant. Instead have a common architectural framework with all the SAP components bundled in one unit.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.